Finotor : The partner for your company’s growth

Finotor: in summary

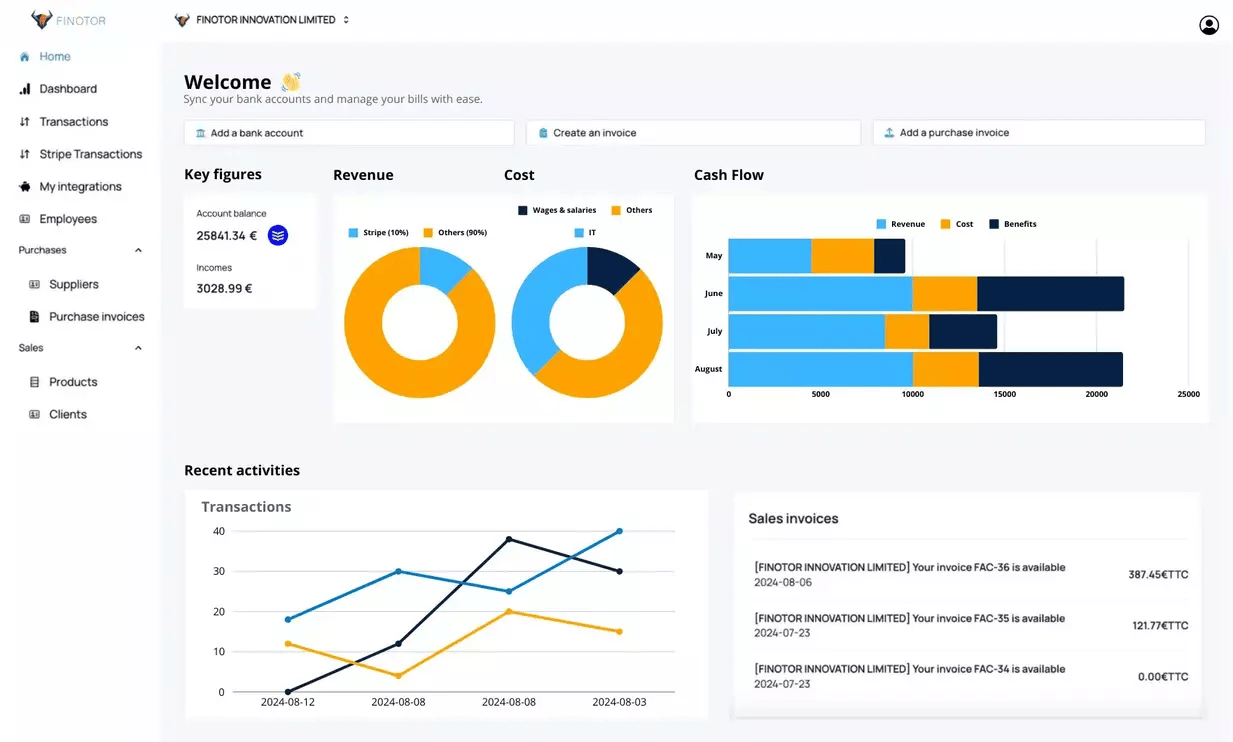

Finotor is a comprehensive accounting and financial management software IA-based, tailored for small businesses, entrepreneurs, and finance teams. It centralizes financial data, automates repetitive tasks, and integrates with leading e-commerce and payment platforms like Stripe and Woocommerce. Finotor’s AI-driven analysis tools make financial decision-making more efficient and precise.

What are the main features of Finotor?

Centralized Financial Management

Finotor simplifies financial management by consolidating all accounting and financial processes into a single platform.

- Unified dashboard: Access your financial data, bank accounts, and transaction history in one place.

- Real-time synchronization: Integrate with Stripe, Woocommerce, and other platforms for seamless data management.

- Automated bookkeeping: Reduce manual entries and eliminate double entry errors.

AI-Based Financial Analysis

Leverage the power of artificial intelligence to optimize financial oversight and decision-making.

- Advanced financial analysis: Generate detailed reports on cash flow, profitability, and financial health.

- Predictive insights: Use AI to forecast future trends based on historical data.

- Automated reconciliations: Effortlessly match transactions and identify discrepancies.

Cloud-Based Access and Security

Manage your business finances anytime and anywhere with Finotor’s secure cloud-based system.

- Multi-device accessibility: Access your data from any device, including mobile and desktop.

- Cloud security: Enjoy enterprise-level data encryption and secure cloud storage.

- Real-time collaboration: Share and collaborate with your team seamlessly.

Seamless Integration with E-commerce Platforms

Finotor’s integrations eliminate data silos, providing a single source of truth for your financial operations.

- Stripe integration: Automate reconciliation and invoice management for payments made through Stripe.

- Woocommerce synchronization: Sync payments, invoices, and orders directly from your Woocommerce store.

- Multi-platform support: Supports other e-commerce platforms like Shopify for comprehensive business management.

Support for Diverse Business Needs

Finotor is designed to accommodate the unique requirements of various business types.

- Small businesses: Streamline financial operations without the need for dedicated accounting staff.

- Startups: Scale quickly with an accounting solution that grows with your business.

- Freelancers and entrepreneurs: Manage expenses, track income, and stay on top of tax obligations.

With Finotor, businesses can save time, reduce errors, and focus on growth rather than on manual financial tasks.

Its benefits

Based AI

Centralize customer invoicing

Boost customer payment

Generate recurring invoices automatically

Automatic transaction categorization

Finotor: its rates

FREE

Free

Lite

€19.00

/month /user

Business

€99.00

/month /1000 users

Clients alternatives to Finotor

Optimize your financial processes with desktop publishing software. Save time and increase efficiency with Esker | S2P & O2C.

See more details See less details

Esker | S2P & O2C is desktop publishing software that makes it easy to manage your purchasing and sales processes. Thanks to its advanced features, you can automate repetitive tasks, reduce errors and improve the visibility of your financial operations.

Read our analysis about Esker | S2P & O2C

Comprehensive solution offering finance, project management, inventory control, and reporting tools to streamline operations and enhance business efficiency.

See more details See less details

BPilot is a comprehensive solution designed to cater to various business needs through its robust finance modules, project management capabilities, efficient inventory control, and insightful reporting tools. This software aims to streamline operations by integrating key processes, enhancing communication across departments, and facilitating data-driven decision-making for improved business efficiency. Its adaptability makes it suitable for various industries looking for an all-in-one ERP system.

Read our analysis about BPilotBenefits of BPilot

Time savings across administrative, financial, and management

Full integration of corporate data within a single cloud platform

Built-in AI Agents that automate repetitive tasks

Streamline your document management with advanced features and user-friendly interface.

See more details See less details

With Welyb, you can easily store, share, and collaborate on documents with version control, audit trails, and granular permissions. The software also offers automated workflows, OCR, e-signatures, and integrations with other tools, making it a comprehensive solution for businesses of all sizes.

Read our analysis about Welyb Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.