Plooto : Payment Automation and Cash Management for Businesses

Plooto: in summary

Plooto is a comprehensive payment automation solution designed to streamline cash management processes for businesses, accounting firms, and finance teams. Its robust feature set includes automated accounts payable and receivable management, international payments, and seamless integration with popular accounting software, making it an ideal choice for companies looking to optimize their financial workflows.

What are the main features of Plooto?

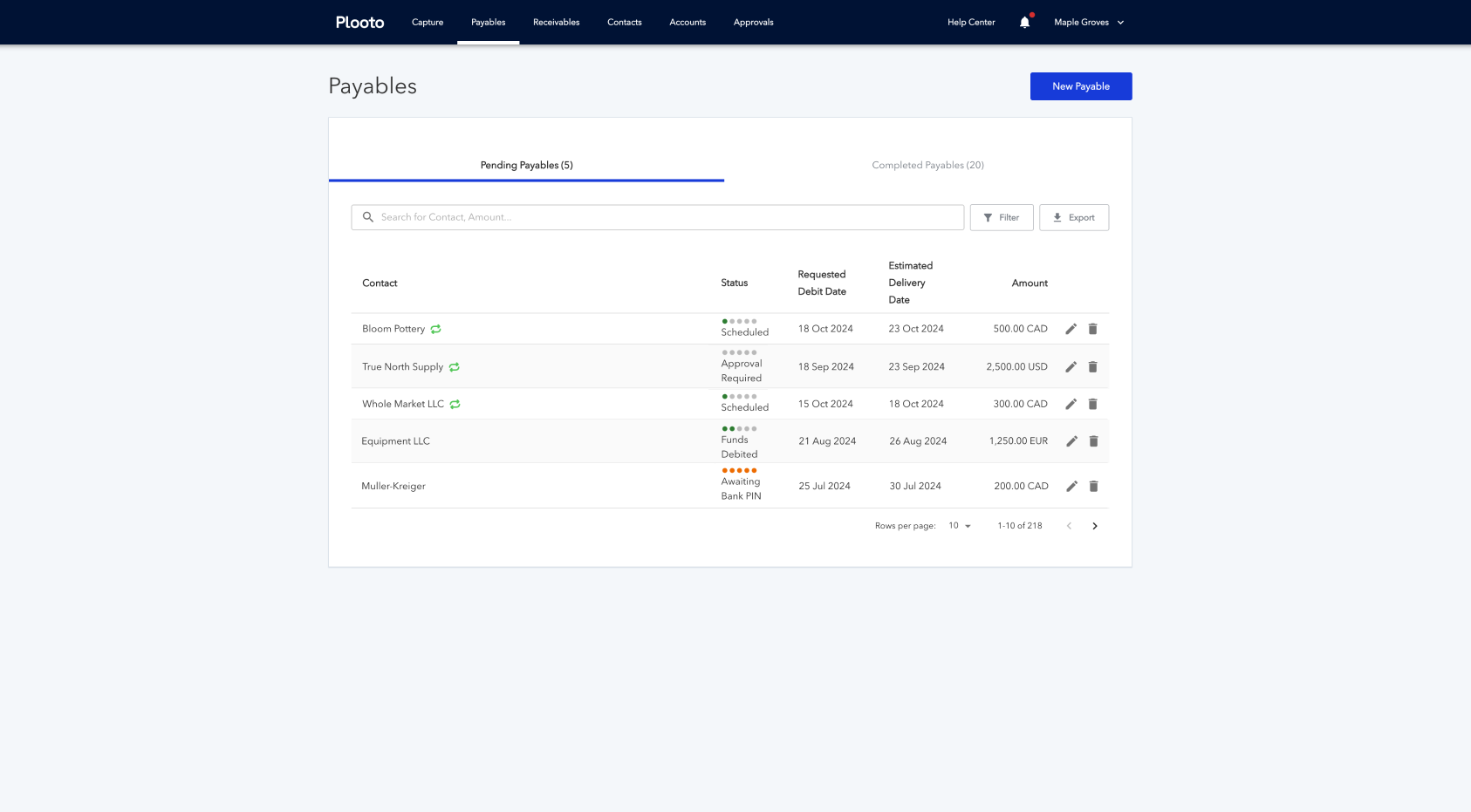

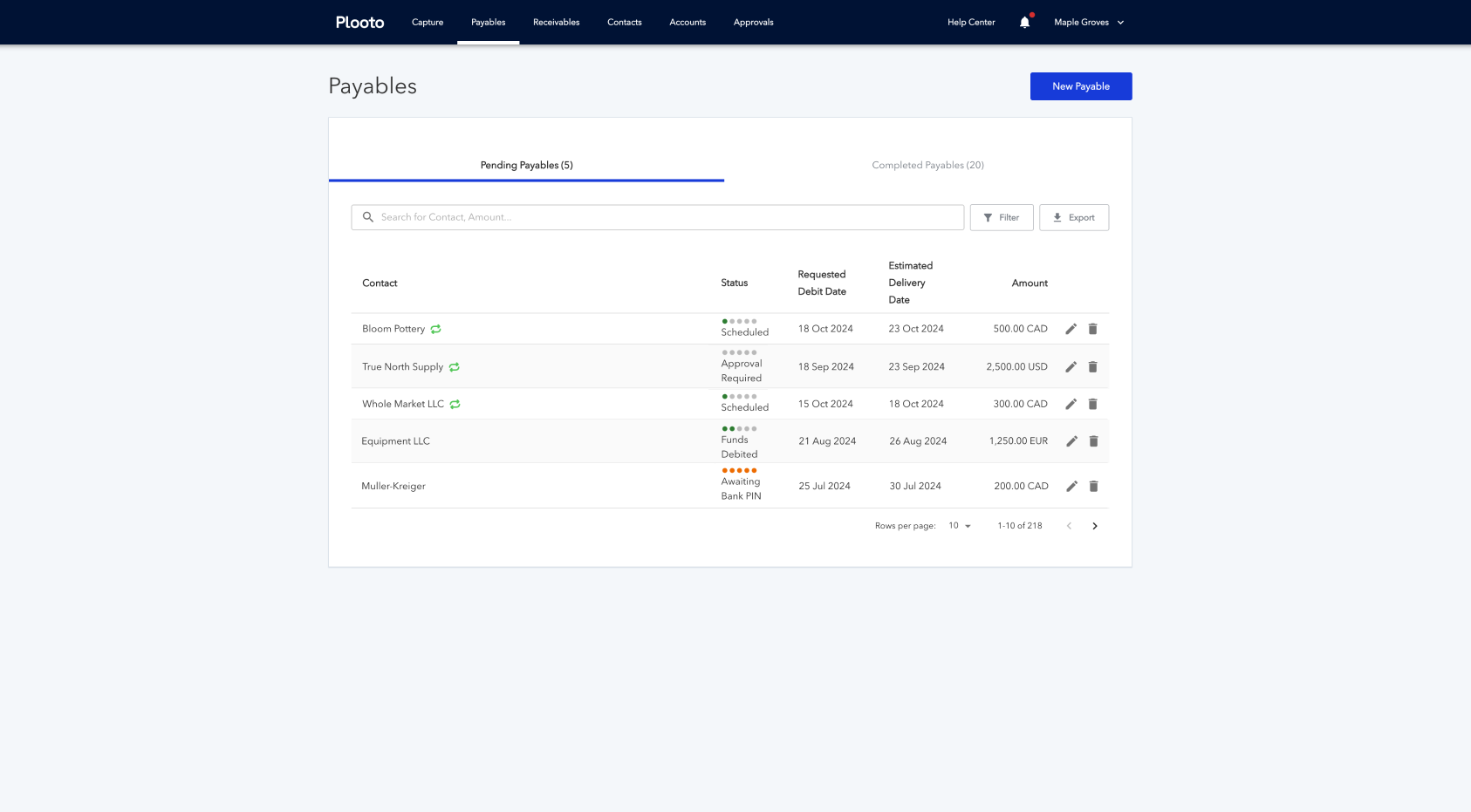

Automated Accounts Payable and Receivable

Plooto simplifies your entire accounts payable and receivable process through automation, reducing manual errors and improving payment efficiency. This feature allows businesses to focus more on growth rather than financial operations.

- Automate the full cycle of payment processing.

- Get paid faster and reduce payment processing mistakes.

- Schedule payments, automate approvals, and manage cash flow effectively.

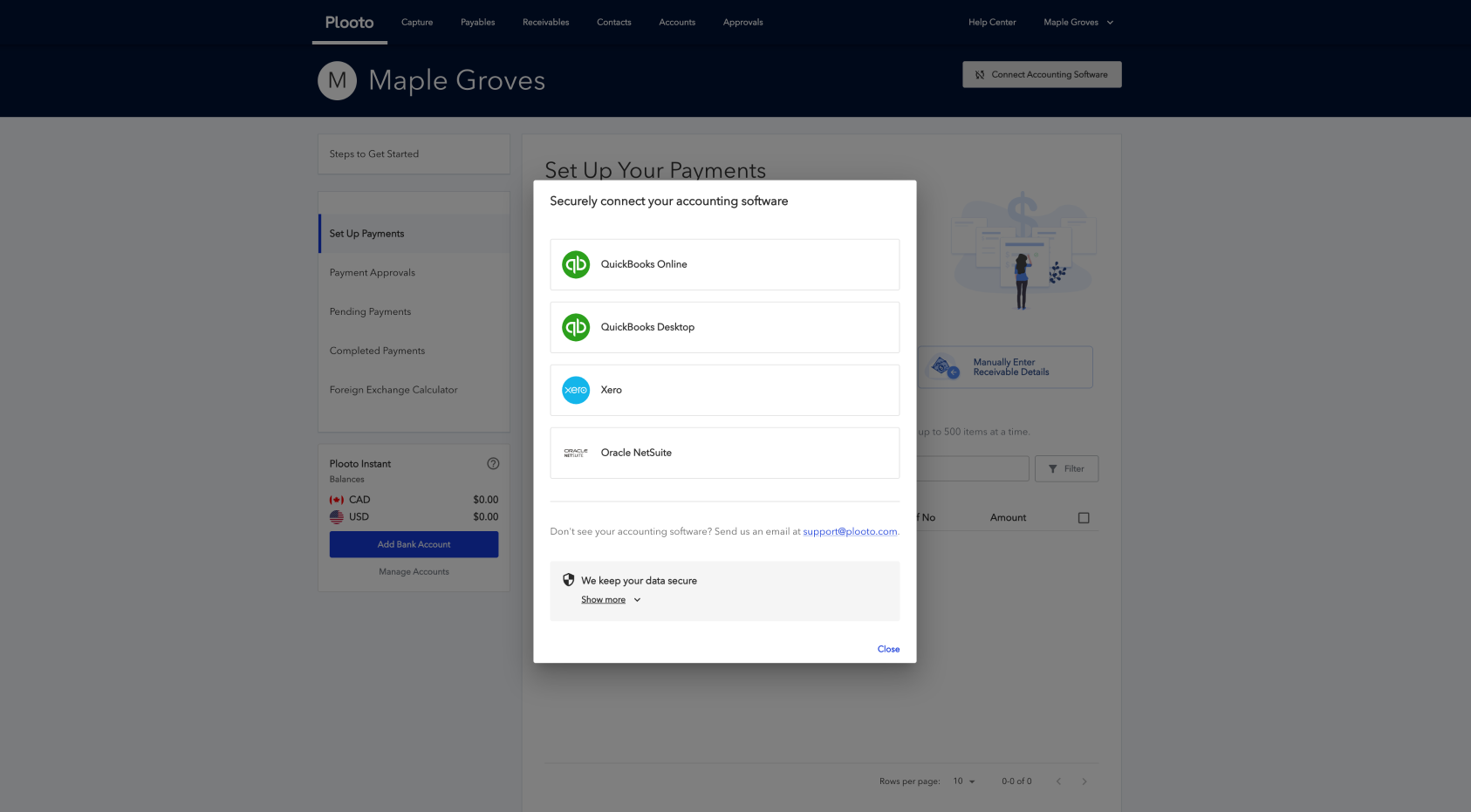

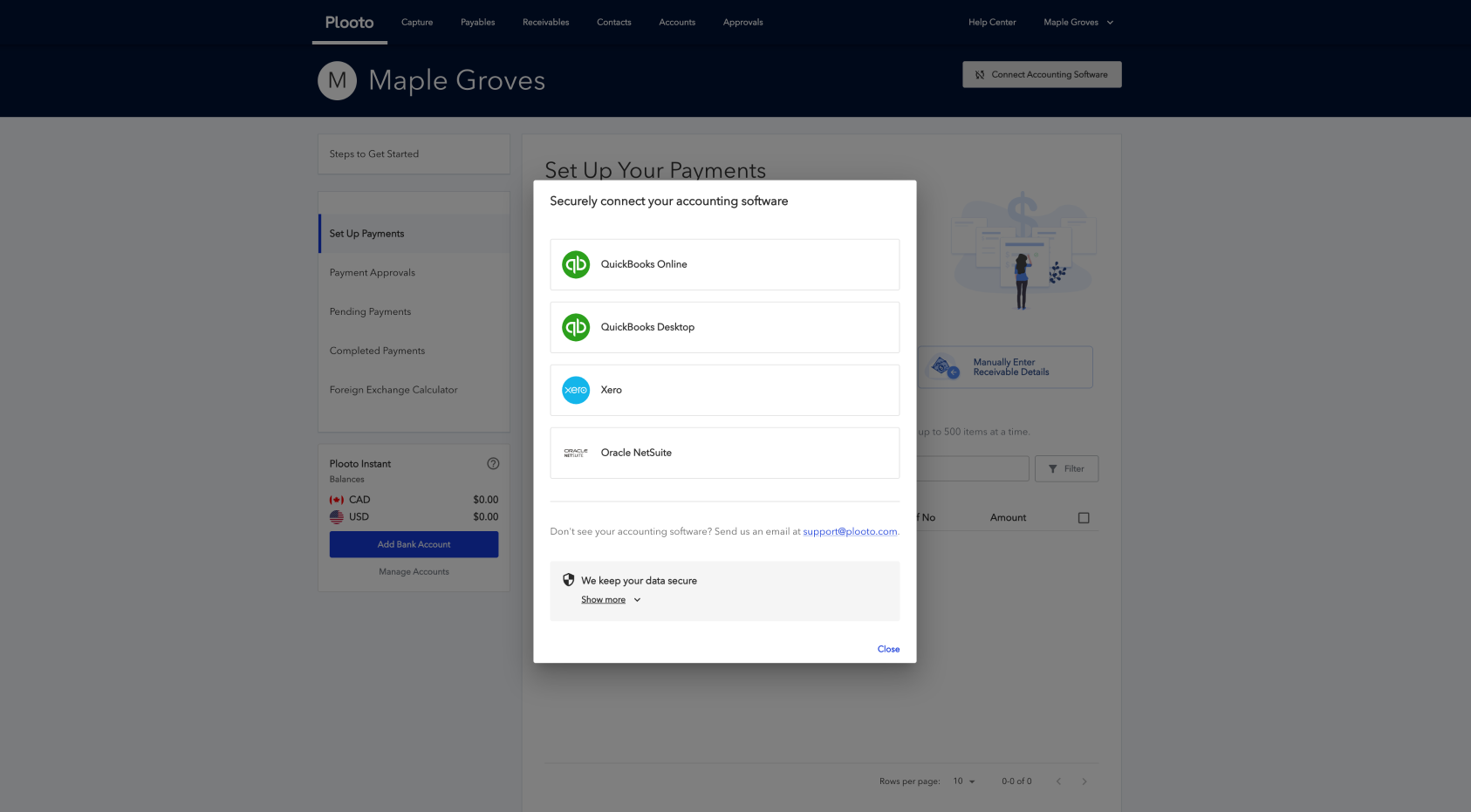

Seamless Integration with Accounting Software

Plooto integrates effortlessly with popular accounting software, ensuring that your payment and reconciliation processes are always up-to-date and error-free. This two-way sync reduces the time spent on manual data entry and helps maintain accurate financial records.

- Integrate with QuickBooks, Xero, and NetSuite.

- Automate payment reconciliation and bookkeeping tasks.

- Eliminate double entries and ensure data consistency.

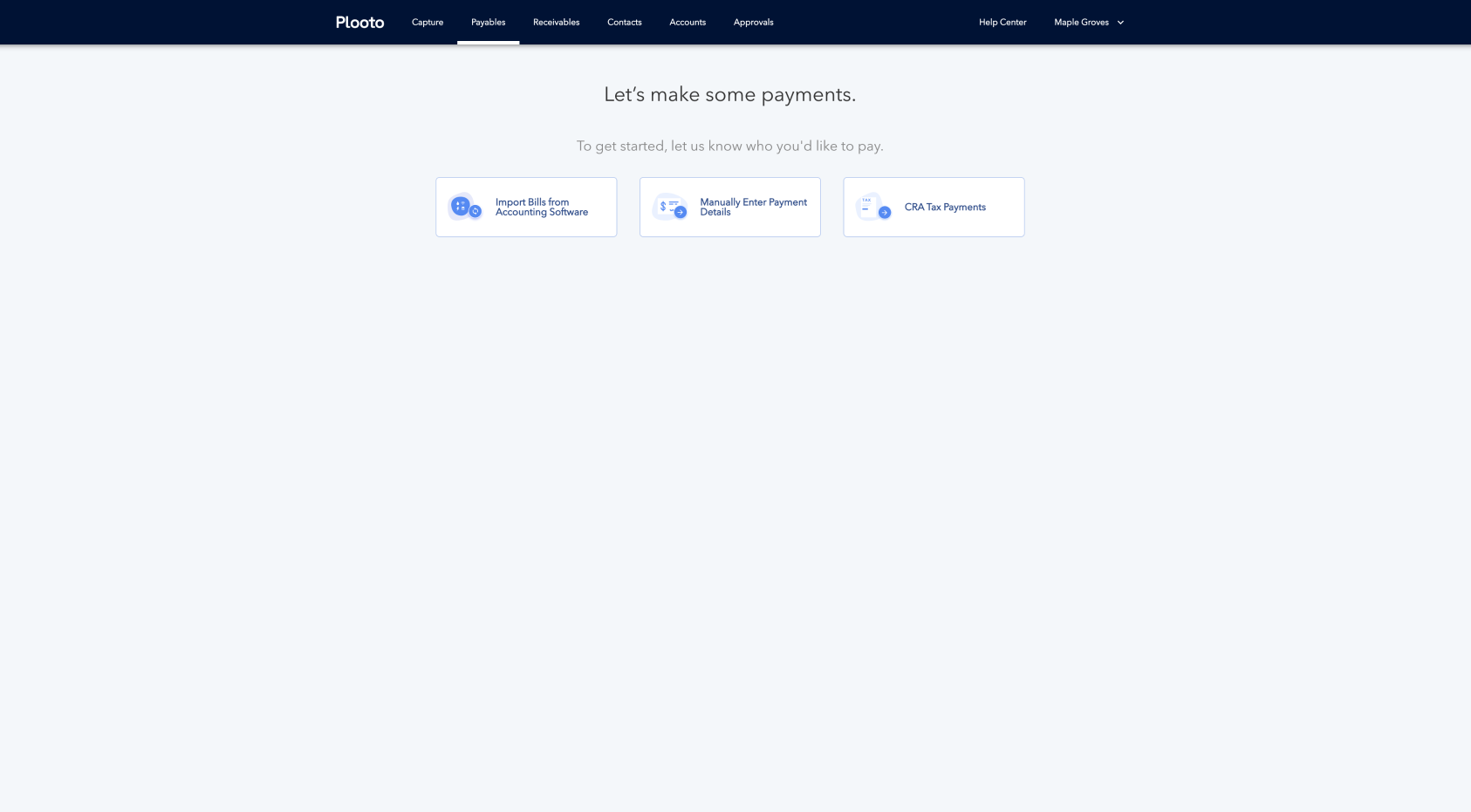

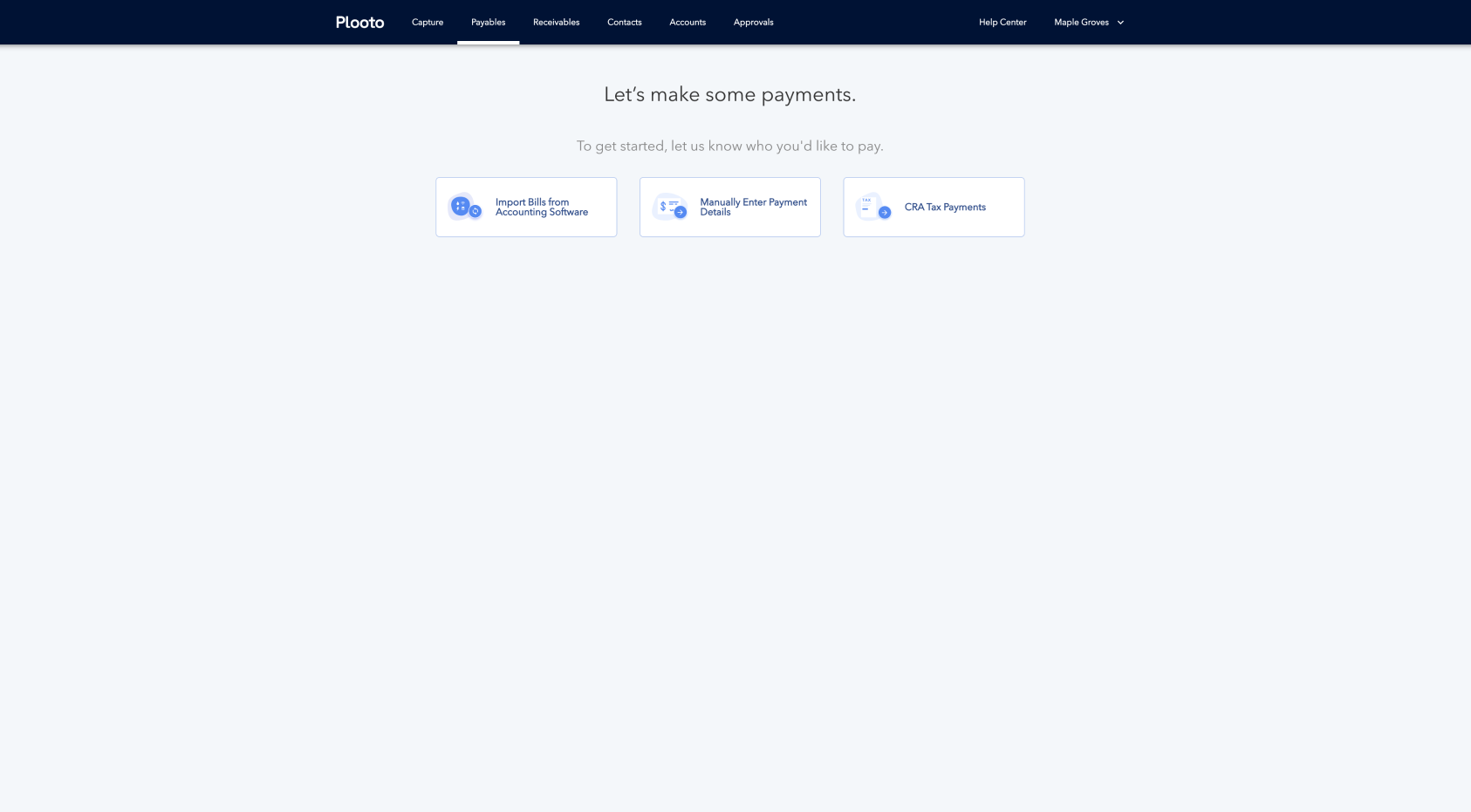

Comprehensive Payment Options

Plooto provides a variety of payment options that help businesses handle both domestic and international transactions seamlessly. Whether it's online check payments or credit card acceptance, Plooto ensures a smooth and secure payment experience.

- Process payments via online checks, ACH transfers, or credit cards.

- Handle international payments with competitive exchange rates.

- Centralize payment workflows across multiple locations and entities.

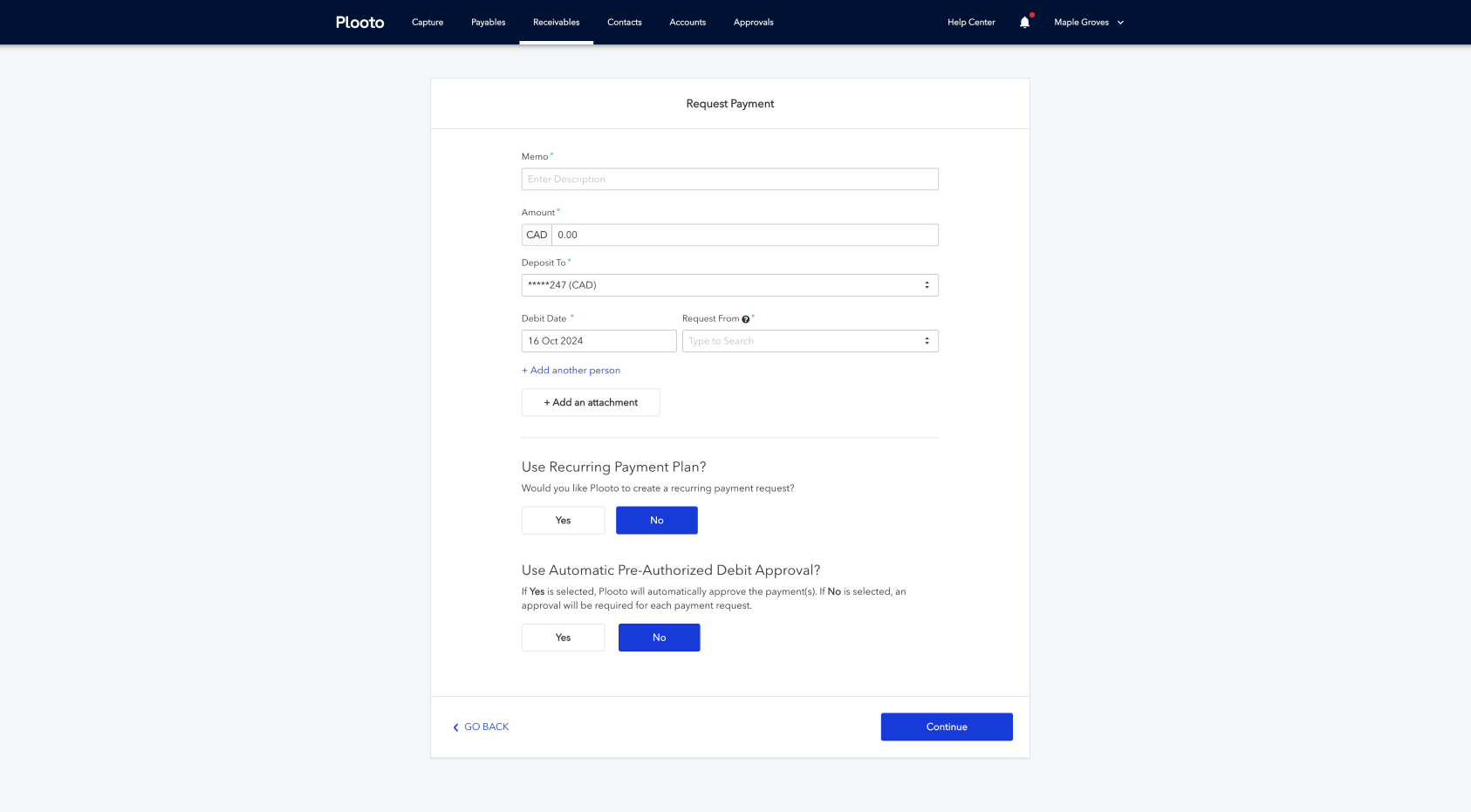

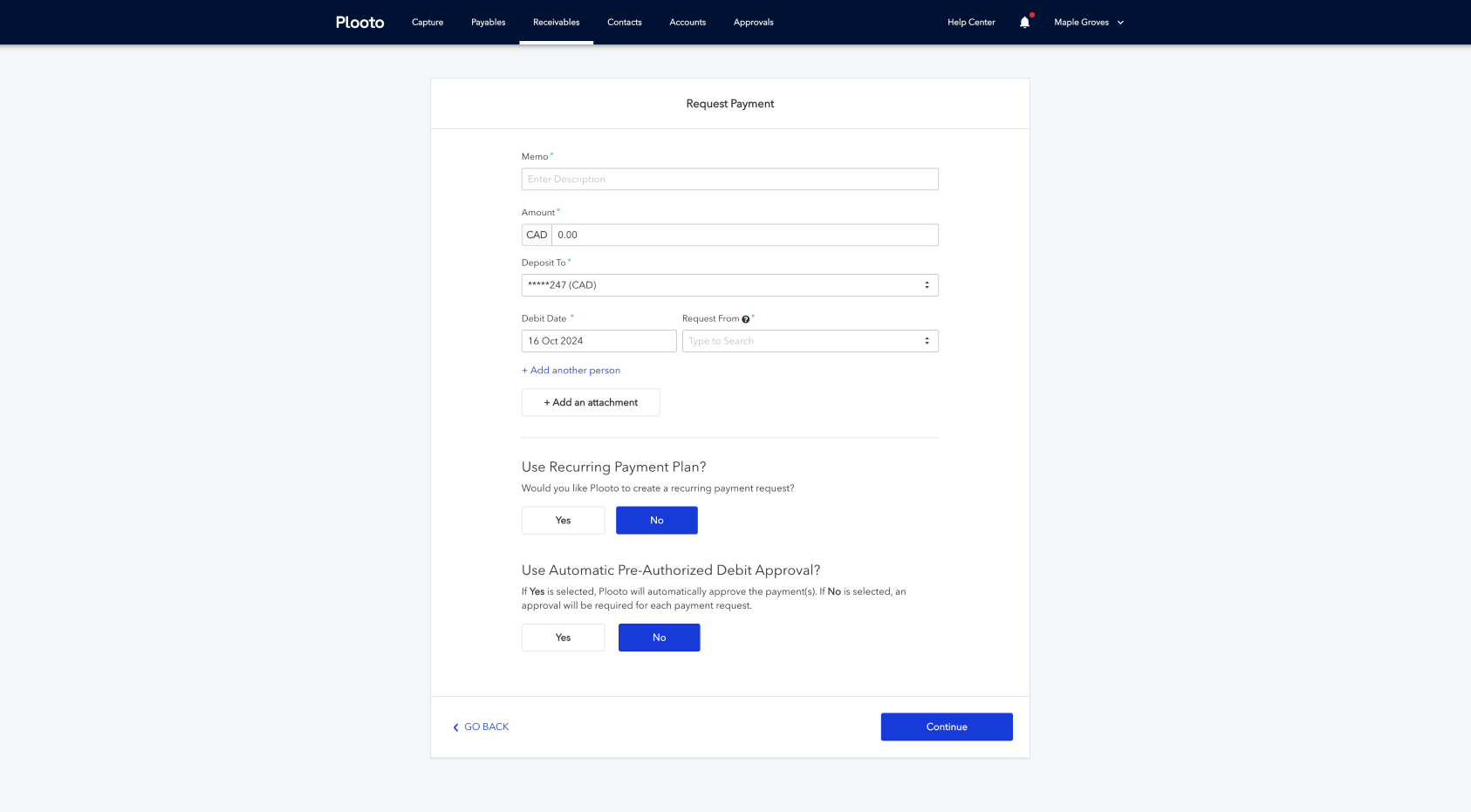

Advanced Invoice Management

With automated invoice management, Plooto minimizes manual involvement in the invoicing process, enabling businesses to focus on more strategic financial tasks.

- Set up recurring invoices and payment reminders.

- Automatically match invoices with payments.

- Reduce human error and streamline the invoicing process.

Enhanced Cash Flow Visibility and Control

Plooto offers enhanced visibility into cash flow, helping finance teams track payments and manage their financial status across all business units.

- Centralized dashboard for real-time cash flow monitoring.

- Automate workflows and approvals to reduce delays.

- Gain insights into cash flow patterns and trends.

Specialized Features for Canadian Businesses

Plooto supports Canada Revenue Agency (CRA) payments, making it easy for Canadian companies to manage their government remittances directly through the platform.

- Pay payroll deductions, GST/HST, and corporate taxes.

- Centralize government remittances alongside other payments.

- Ensure compliance and streamline tax-related payments.

Secure and Scalable for Growing Businesses

Plooto is built to scale with your business, offering secure and reliable solutions that grow with your needs.

- Multi-user access with approval workflows.

- Add and manage payees and company users easily.

- Leverage Plooto’s security features and authentication methods.

Plooto’s all-in-one cash management platform is designed to meet the needs of businesses, accounting firms, and finance teams, making it a go-to solution for those looking to automate and streamline their financial operations.

Its benefits

Automatic two-way sync with QuickBooks Online and Xero

Automatic invoice processing with Plooto Capture (OCR)

End-to-end encryption with multi-factor authentication

Plooto - Screenshot 1

Plooto - Screenshot 1  Plooto - Screenshot 2

Plooto - Screenshot 2  Plooto - Screenshot 3

Plooto - Screenshot 3  Plooto - Screenshot 4

Plooto - Screenshot 4

Plooto: its rates

Standard

Rate

On demand

Clients alternatives to Plooto

Efficient payment processing, easy scheduling, and secure transactions for businesses.

See more details See less details

Melio offers a streamlined payment processing solution, designed for businesses aiming for efficiency and security in their financial transactions. It supports easy scheduling of payments and ensures transactions are completed securely, enabling smoother cash flow management and saving time on administrative tasks.

Read our analysis about MelioBenefits of Melio

Pay vendors the way you want

Improve cash flow management

Vendors get paid the way they want, even if they are not Melio users

To Melio product page

Manage corporate travel effortlessly with automated booking, expense tracking, and comprehensive reporting features.

See more details See less details

Navan simplifies corporate travel management with features like automated booking tailored to company policies, real-time expense tracking, and robust reporting tools. Its user-friendly interface ensures seamless integration with existing workflows. By reducing administrative work, this tool enhances productivity and cost control.

Read our analysis about NavanBenefits of Navan

No booking fees or hidden costs

Access to exclusive travel discounts

Easy creation of travel policies across the organization

To Navan product page

Powerful desktop publishing software with advanced design tools and templates for creating stunning print and digital media.

See more details See less details

With Yooz, users can easily design flyers, brochures, newsletters, and more with intuitive drag-and-drop tools. The software also features a wide range of templates and fonts to choose from, as well as the ability to import graphics and images for a truly custom look. Plus, Yooz supports both print and digital media, making it a versatile choice for any project.

Read our analysis about YoozTo Yooz product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.