VisionCredit Fintech : Streamlined Credit Solutions for Fintech Enthusiasts

VisionCredit Fintech: in summary

VisionCredit Fintech targets professionals in the financial sector seeking cutting-edge solutions to credit management. With features like AI-driven credit scoring, instant loan processing, and comprehensive analytics, this software stands out as a leader in fintech innovation.

What are the main features of VisionCredit Fintech?

AI-Driven Credit Scoring

Enhance your financial assessments with VisionCredit Fintech’s AI-driven credit scoring. This feature utilizes advanced machine learning algorithms to provide accurate and dynamic credit scores, offering deeper insights and faster decision-making. Enjoy benefits such as:

- Real-time credit insights

- Adaptive credit models

- Improved lending accuracy

Instant Loan Processing

Accelerate your financial services with instant loan processing, designed to expedite borrower-lender interactions. VisionCredit Fintech automates and simplifies the loan approval workflow, ensuring timely responses and satisfied clients. Key advantages include:

- Automated loan assessments

- Seamless application processing

- Quick funding disbursement

Comprehensive Analytics

Stay ahead by leveraging comprehensive analytics tools that transform data into actionable insights. VisionCredit Fintech provides detailed reporting and performance metrics to assist in strategic planning and optimizing financial operations. Features include:

- In-depth financial reporting

- Customizable dashboards

- Predictive analytics capabilities

Its benefits

GDPR

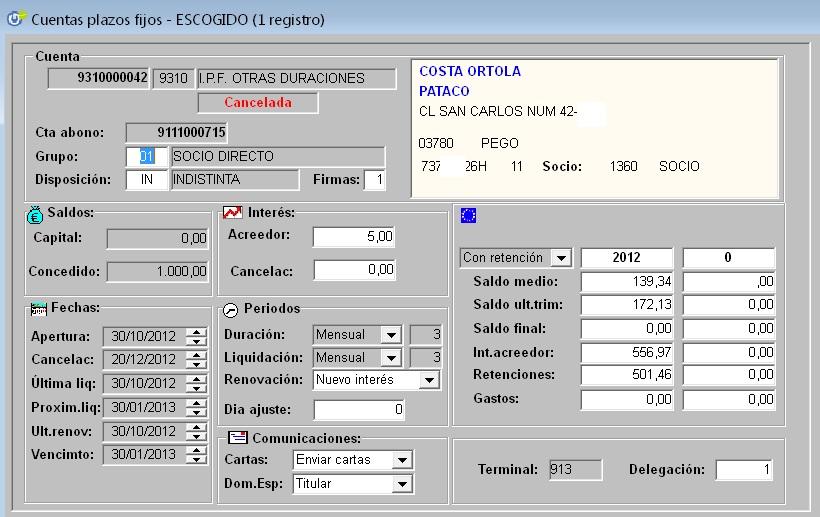

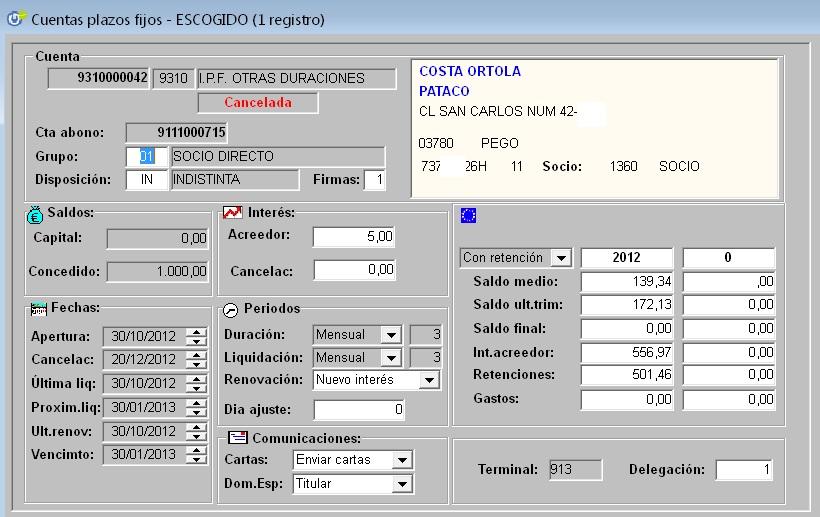

VisionCredit Fintech - Screenshot 1

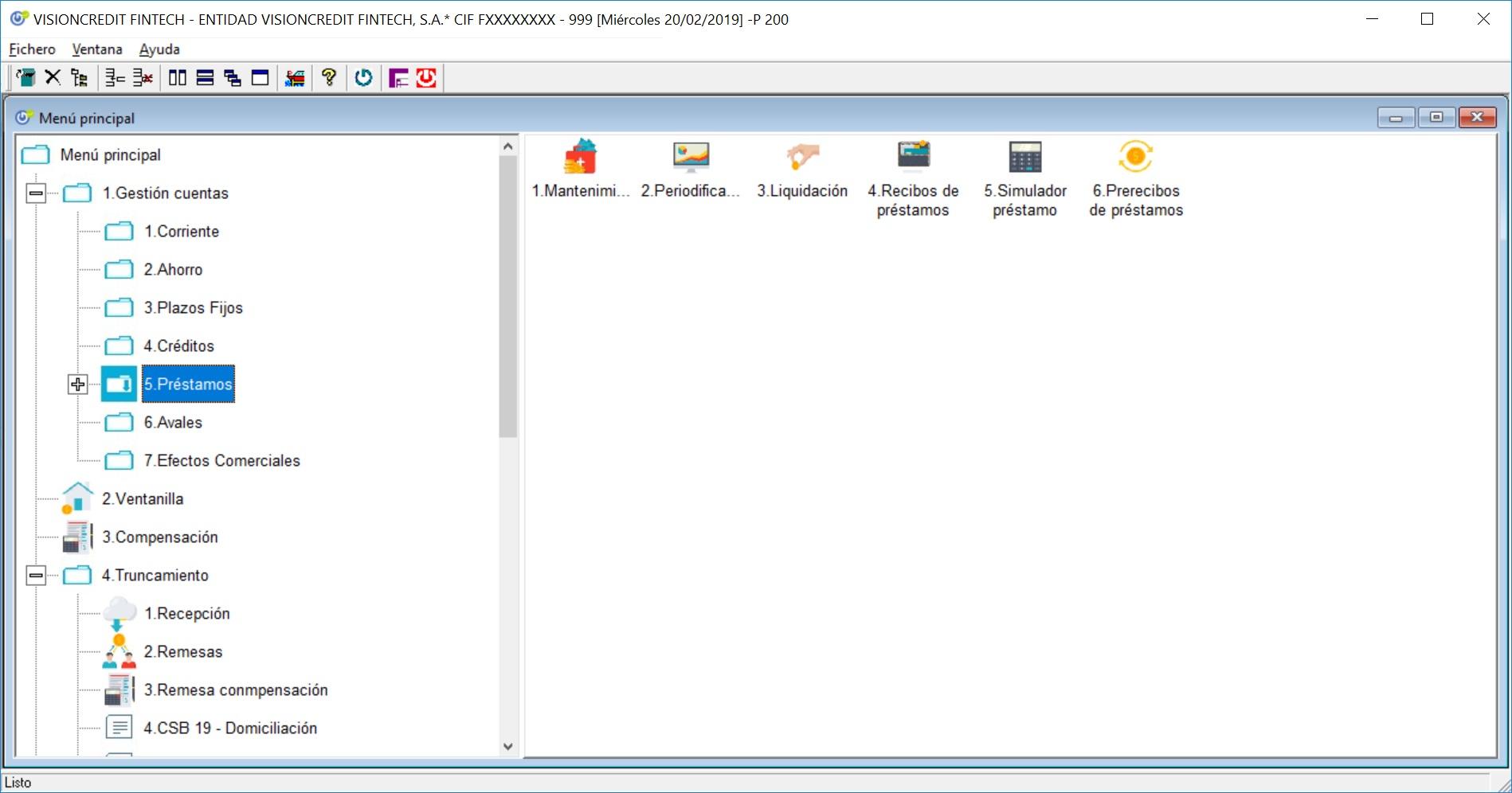

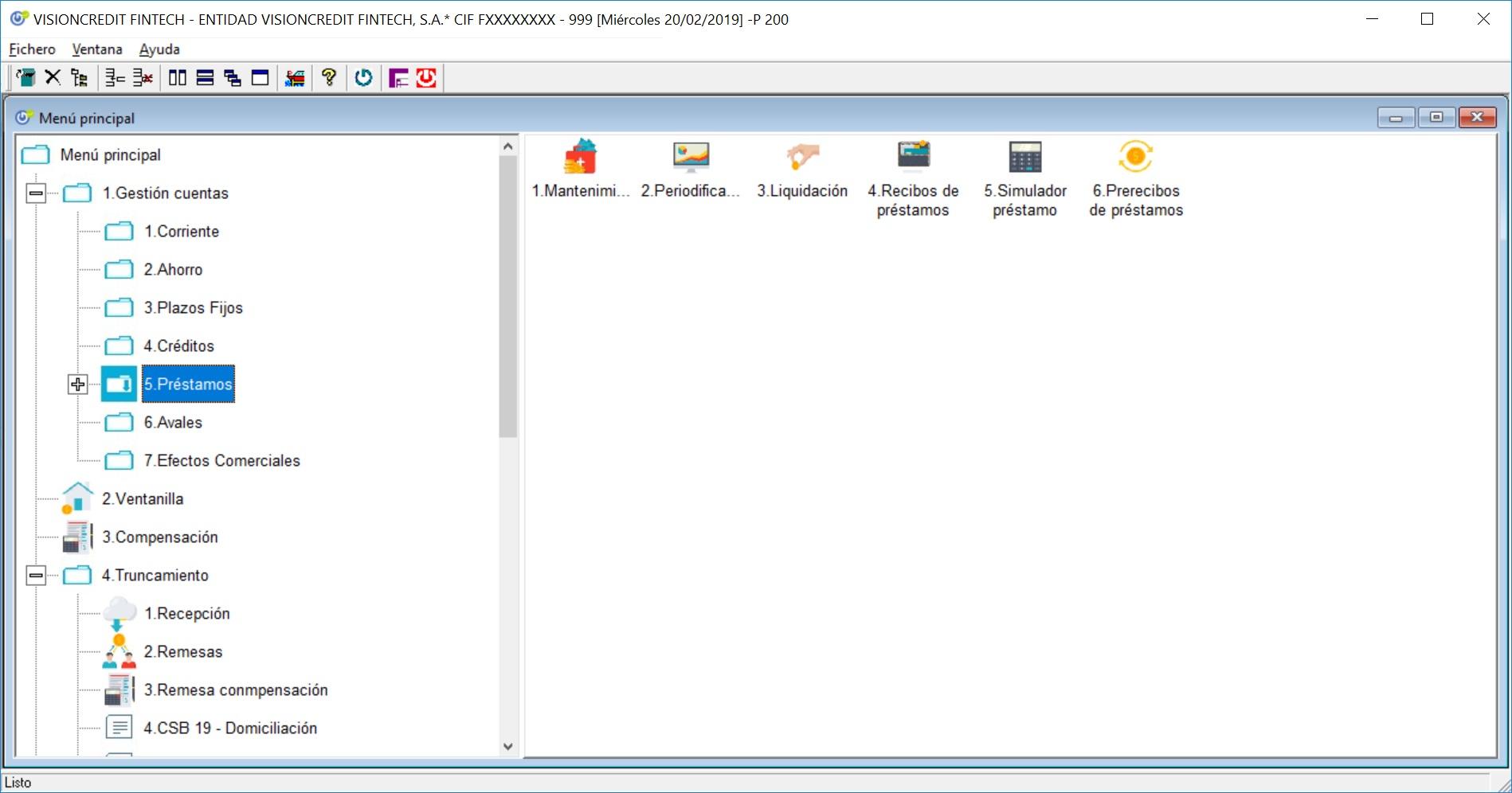

VisionCredit Fintech - Screenshot 1  VisionCredit Fintech - Screenshot 2

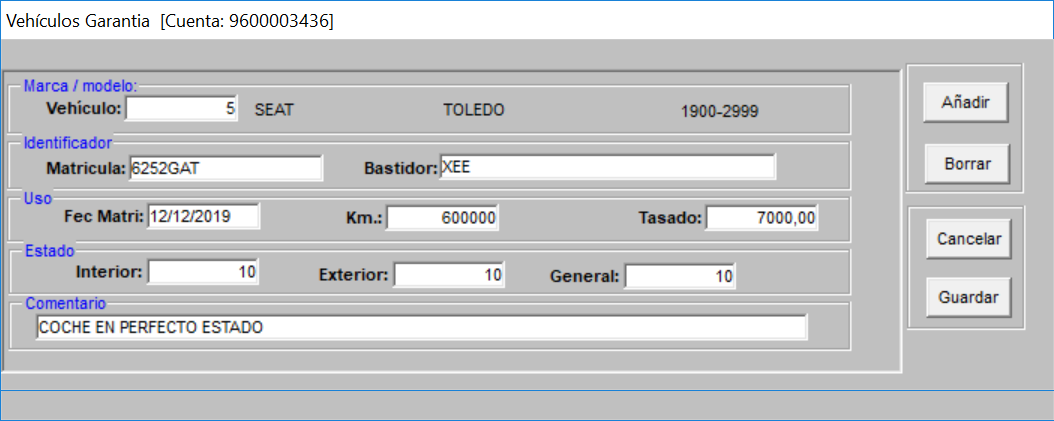

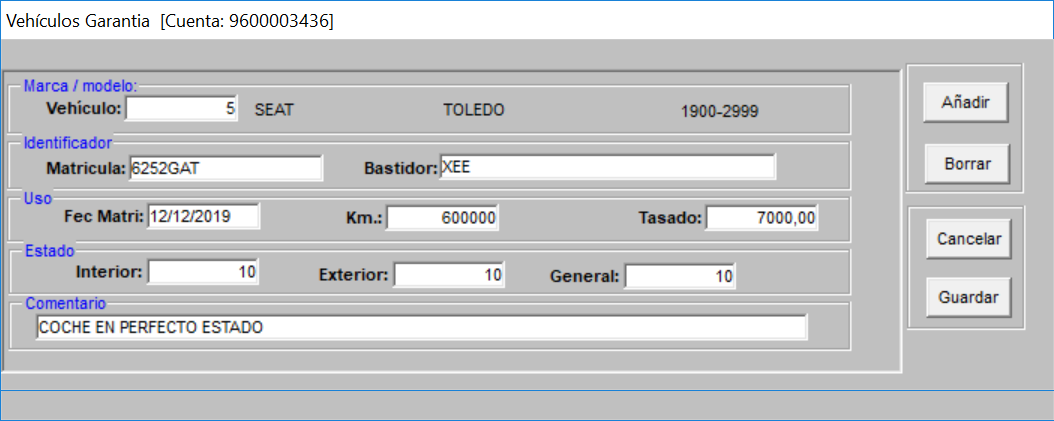

VisionCredit Fintech - Screenshot 2  VisionCredit Fintech - Screenshot 3

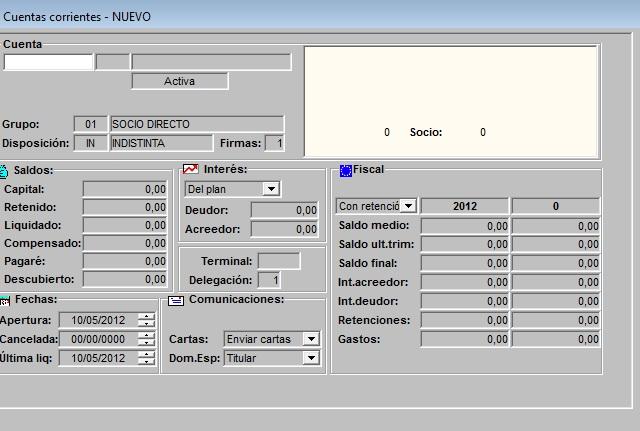

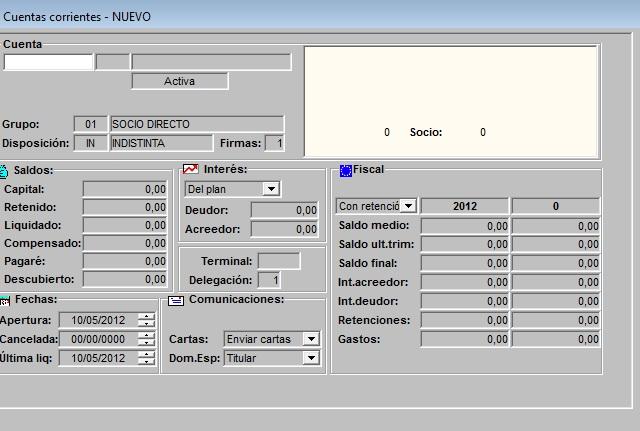

VisionCredit Fintech - Screenshot 3  VisionCredit Fintech - Screenshot 4

VisionCredit Fintech - Screenshot 4  VisionCredit Fintech - Screenshot 5

VisionCredit Fintech - Screenshot 5  VisionCredit Fintech - Screenshot 6

VisionCredit Fintech - Screenshot 6

VisionCredit Fintech: its rates

Gratuita

Free

Esential

$999.00

/user

Gold

Rate

On demand

Standard

Rate

On demand

Clients alternatives to VisionCredit Fintech

Manage corporate travel effortlessly with automated booking, expense tracking, and comprehensive reporting features.

See more details See less details

Navan simplifies corporate travel management with features like automated booking tailored to company policies, real-time expense tracking, and robust reporting tools. Its user-friendly interface ensures seamless integration with existing workflows. By reducing administrative work, this tool enhances productivity and cost control.

Read our analysis about NavanBenefits of Navan

No booking fees or hidden costs

Access to exclusive travel discounts

Easy creation of travel policies across the organization

To Navan product page

Powerful desktop publishing software with advanced design tools and templates for creating stunning print and digital media.

See more details See less details

With Yooz, users can easily design flyers, brochures, newsletters, and more with intuitive drag-and-drop tools. The software also features a wide range of templates and fonts to choose from, as well as the ability to import graphics and images for a truly custom look. Plus, Yooz supports both print and digital media, making it a versatile choice for any project.

Read our analysis about YoozTo Yooz product page

Efficient payment processing, easy scheduling, and secure transactions for businesses.

See more details See less details

Melio offers a streamlined payment processing solution, designed for businesses aiming for efficiency and security in their financial transactions. It supports easy scheduling of payments and ensures transactions are completed securely, enabling smoother cash flow management and saving time on administrative tasks.

Read our analysis about MelioBenefits of Melio

Pay vendors the way you want

Improve cash flow management

Vendors get paid the way they want, even if they are not Melio users

To Melio product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.