Melio : Revolutionizing B2B Payments & Amplify Cash Flow

Melio: in summary

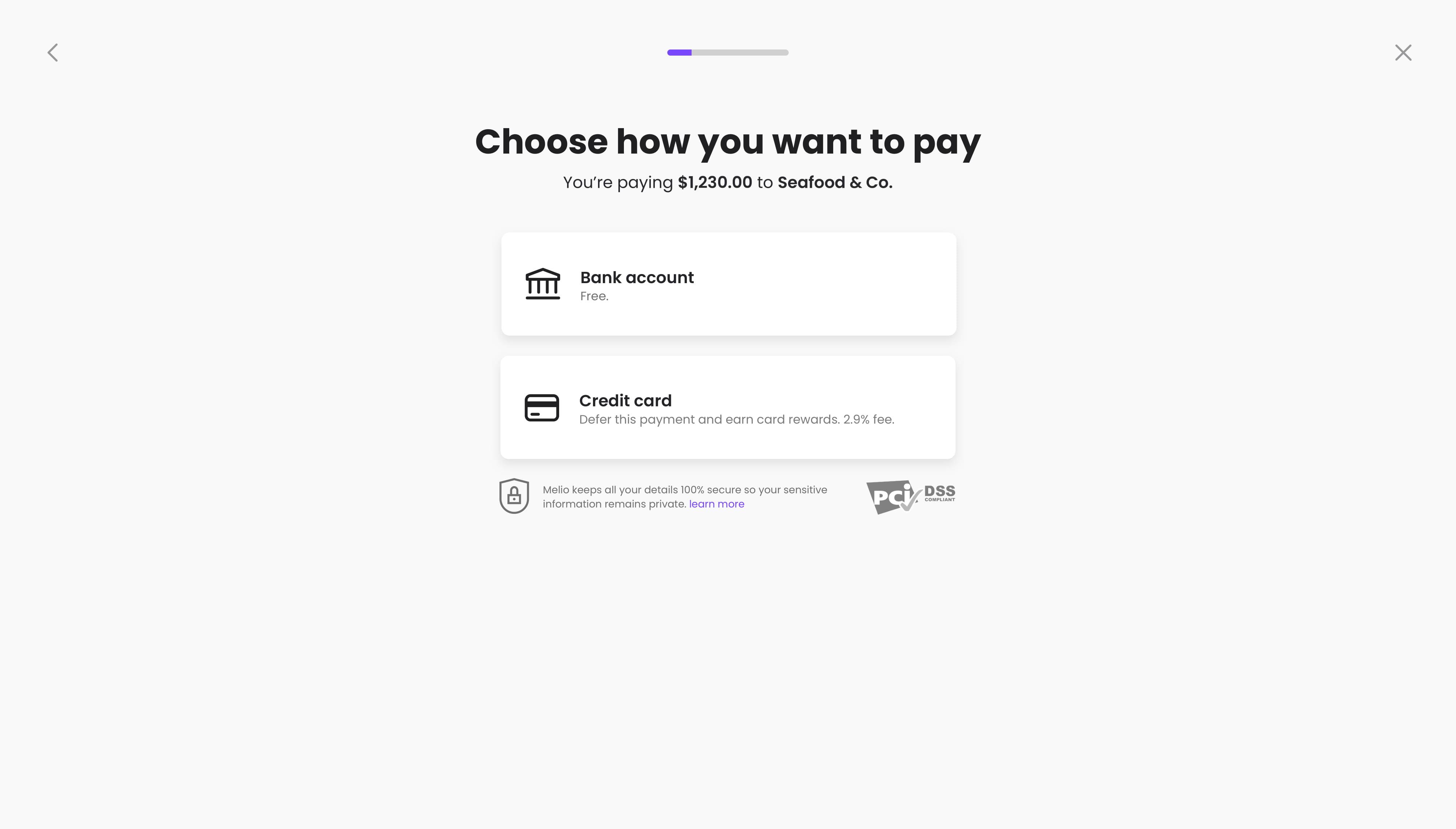

Melio gives small to medium-sized businesses the simplest tool to pay their vendors, contractors, and all other business bills – with no subscription fees. Enjoy total payment flexibility —ACH, debit, or credit card.

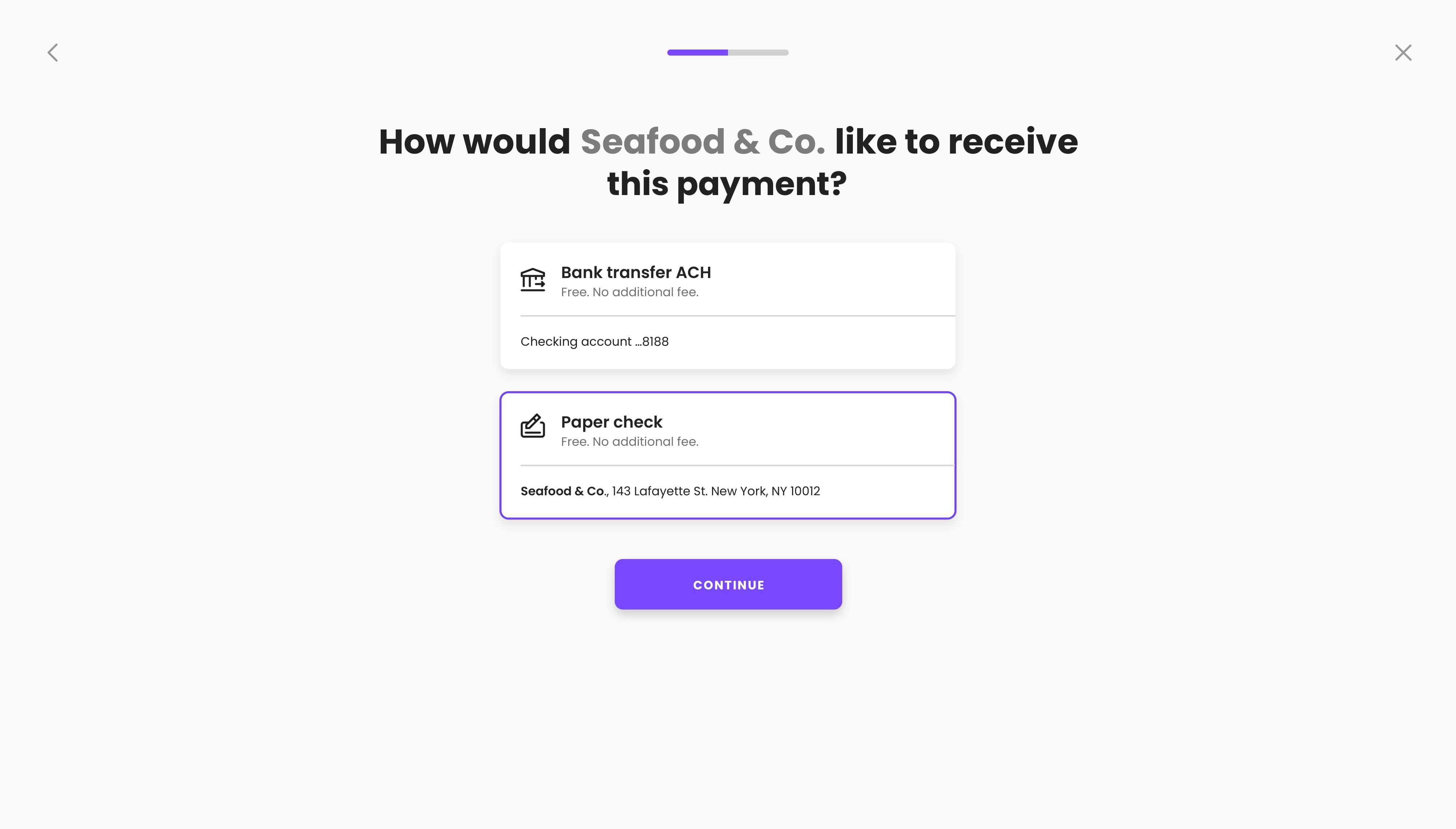

Vendors still get paid however they want (check or bank transfer).

Melio streamlines the payment process so you can save 50% of the time you spend on bill pay. With automated features and faster payment and delivery options, your vendors get paid while you can hold on to cash for longer. Manage even more with Melio’s mobile app for iOS—the easiest way to send and track payments on the go.

Who is Melio made for?

Melio is tailored for small and medium-sized businesses, particularly those without extensive internal accounting resources.

It offers a flexible, user-friendly payment solution, focusing on enhancing cash flow management and simplifying accounts payable processes. Predominantly serving the U.S. market, Melio addresses the unique challenges and needs of SMBs.

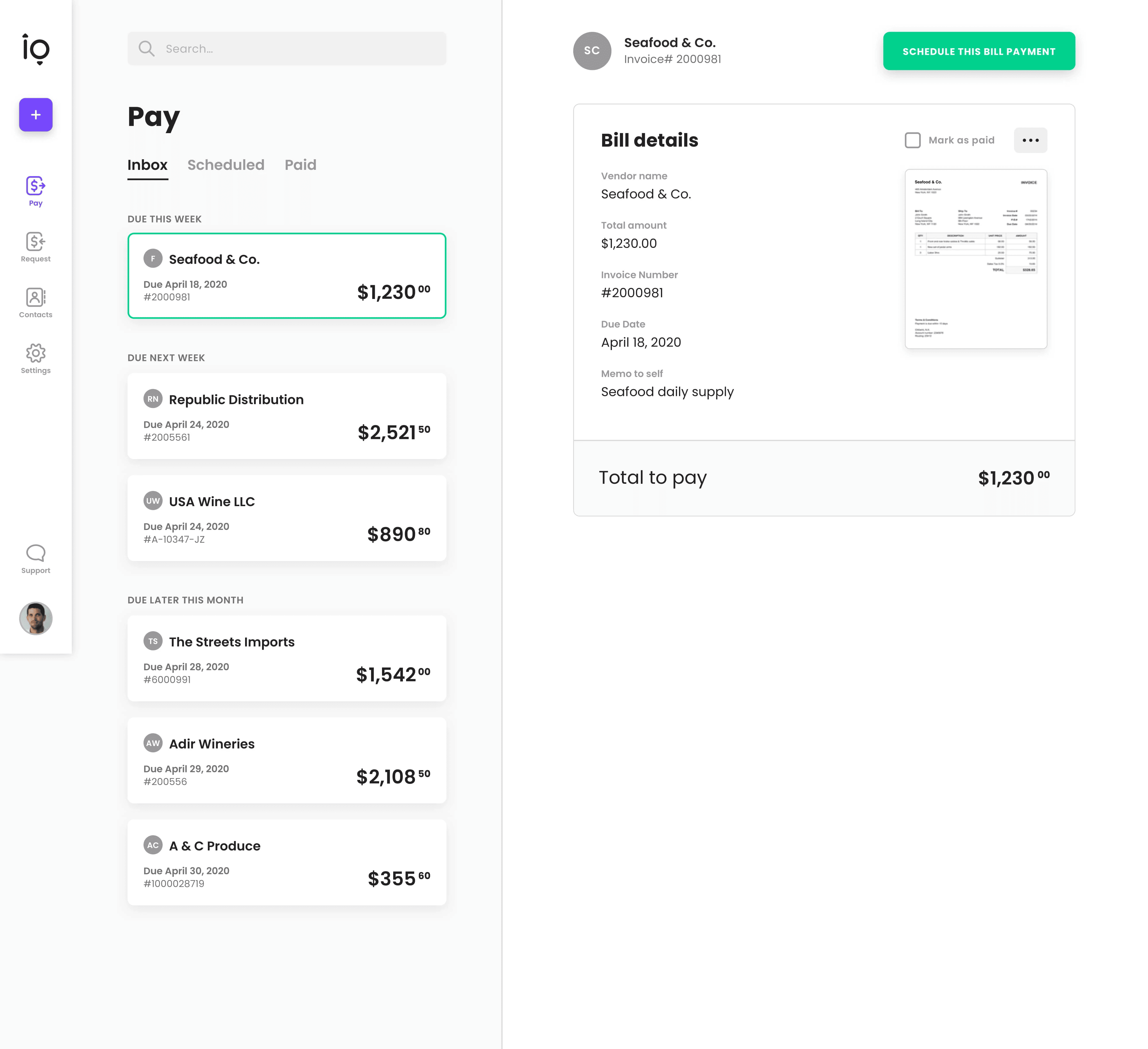

Melio Enhances Accounts Payable

Melio's Accounts Payable (AP) features significantly ease the process of managing outgoing payments. For instance, companies can:

- schedule payments ahead of time,

- ensuring bills are paid punctually,

- thereby avoiding late fee

- and maintaining good vendor relationships!

The flexibility of payment methods, including the use of credit cards, allows businesses to optimize their cash flow. For example, a small business can leverage credit card payments to defer actual cash outflows and earn rewards.

Melio also Streamles Accounts Receivable

On the Accounts Receivable front, Melio facilitates the invoice-to-payment cycle. Businesses can send digital invoices and receive payments online, reducing the time between billing and cash receipt.

This feature is particularly beneficial for service-based companies that often face payment delays. By streamlining this process, businesses can expect:

- improved cash flow,

- quicker turnaround on receivables,

- and reduced administrative burden.

What's not to love?

Pros & Cons of Melio

Melio's Pros

Melio stands out for its no-cost ACH bank transfers and a range of flexible payment methods, including the ability to use credit cards in scenarios where they are typically not accepted. Its integration with popular accounting software like QuickBooks and Xero adds to its appeal, offering streamlined financial management. The platform is also recognized for its user-friendly interface, which enhances the overall user experience.

Melio's Cons

However, Melio's pricing structure includes fees for certain transactions like card payments and expedited transfers, which could be a drawback for some users - see Pricing below for more info on Melio free and paid features. Additionally, the absence of an Android app restricts accessibility for a segment of users.

Its benefits

Pay vendors the way you want

Improve cash flow management

Vendors get paid the way they want, even if they are not Melio users

Free, no subscription fees

Its disadvantages

No Android App yet (coming soon!)

Appvizer's opinion

Appvizer's opinion

It’s clear Melio has made a name for itself among businesses and professionals seeking a simple yet powerful payments tool. The user-friendly interface makes managing the accounts payable process a lot easier for us, especially for those who are less tech-savvy.

What stands out with Melio is the simplicity and flexibility, including paying vendors by card where cards aren’t typically accepted. Plus, that flexibility is passed on to vendors—they can get a bank transfer or check.

Melio also offers more automated capabilities to save us time, like seamless accounting software integration, invoice-to-inbox automation, easy bill capture, approval workflows, and more. With the recent upgrade to Melio’s sleek look and feel, we get an even better overview of vendors, bills, and payments with the new dashboard look.

We’re anticipating Melio’s upcoming release of Real-time payments (RTP) to make already fast payments seem even faster.

Melio: its rates

Melio offers a range of pricing options for its services, tailored to meet the diverse needs of businesses.

First, it's important to note that ACH Bank Transfers are provided free of charge, allowing businesses to send and receive bank transfers without any subscription fees!

Other primary services include:

- Mailing Checks: Melio allows the first two checks each month to be mailed for free. After that, each check costs $1.50.

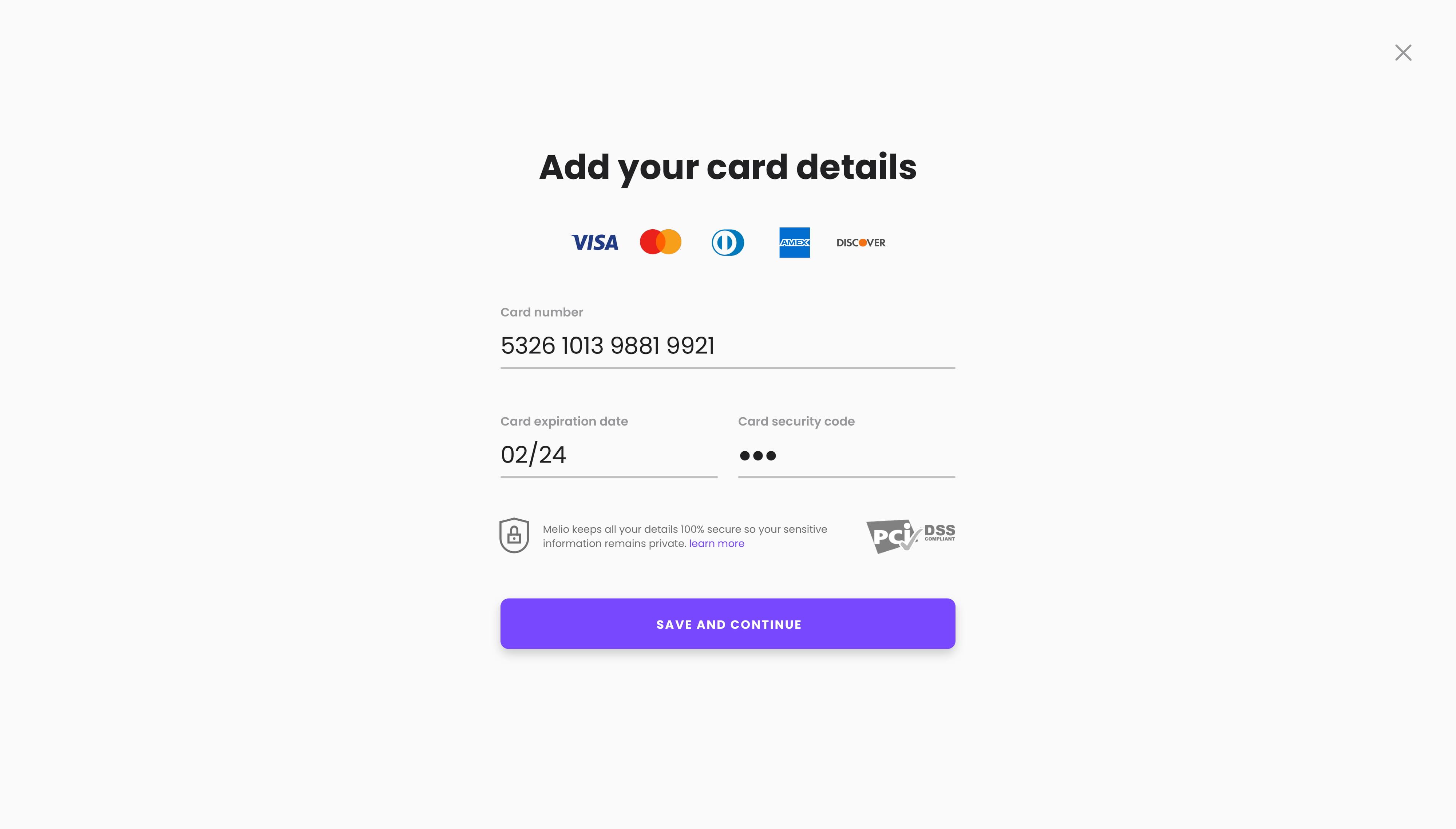

- Card Payments: Payments made by credit card incur a fee of 2.9%.

- Instant Transfers: For vendors to receive payment within minutes, Melio charges a fee of 1.5%, with a maximum of $50.

- Fast ACH Bank Transfers: This service ensures that vendors are paid by the end of the day, with a fee of 1%, up to $30.

- Fast Checks: For a check to reach a vendor within 3 business days, a fee of $20 is charged.

- International Payments: Melio supports international payments (in USD only), with a flat fee of $20. If payment is made using a Mastercard, an additional 2.9% fee is applicable.

Melio supports payment via virtual cards for online business expenses and offers the flexibility to split bills into multiple payments and payment methods, enhancing cash flow management.

Standard

Rate

On demand

Clients alternatives to Melio

Manage corporate travel effortlessly with automated booking, expense tracking, and comprehensive reporting features.

See more details See less details

Navan simplifies corporate travel management with features like automated booking tailored to company policies, real-time expense tracking, and robust reporting tools. Its user-friendly interface ensures seamless integration with existing workflows. By reducing administrative work, this tool enhances productivity and cost control.

Read our analysis about NavanBenefits of Navan

No booking fees or hidden costs

Access to exclusive travel discounts

Easy creation of travel policies across the organization

To Navan product page

Powerful desktop publishing software with advanced design tools and templates for creating stunning print and digital media.

See more details See less details

With Yooz, users can easily design flyers, brochures, newsletters, and more with intuitive drag-and-drop tools. The software also features a wide range of templates and fonts to choose from, as well as the ability to import graphics and images for a truly custom look. Plus, Yooz supports both print and digital media, making it a versatile choice for any project.

Read our analysis about YoozTo Yooz product page

Offers fast global payments, competitive currency exchange rates, multi-currency accounts, and robust fraud protection features for businesses of all sizes.

See more details See less details

Airwallex provides a comprehensive suite of payment processing solutions tailored for modern businesses. It facilitates fast global payments with minimal fees and offers attractive currency exchange rates. With multi-currency accounts, businesses can manage their finances in different currencies seamlessly. Additionally, Airwallex incorporates advanced fraud protection measures, ensuring secure transactions and mitigating risks. This makes it suitable for both startups and established enterprises looking to streamline their payment operations.

Read our analysis about AirwallexTo Airwallex product page

Melio: the complete test

In today's ever-evolving business landscape, efficiency, simplicity, and strategic cash flow management are all important for success. Melio emerges as a highly trusted solution tailored to meet these needs.

Let's dive deeper into the top features that set Melio apart:

Unparalleled Flexibility in Payment Modes

With Melio, you're not only sending payments; you're taking control of how you send them. The platform offers unparalleled flexibility, allowing businesses to pay with credit cards, even if the vendor doesn't typically accept them. This is a game-changer for many businesses, particularly for those wishing to maximize their card rewards or seeking to push payments out to optimize cash flow.

Vendors get paid hassle-free, in the way they prefer, even if they aren't Melio users. This flexibility ensures a seamless payment experience, making for stronger business relationships and ensuring trust.

Streamlined User Experience

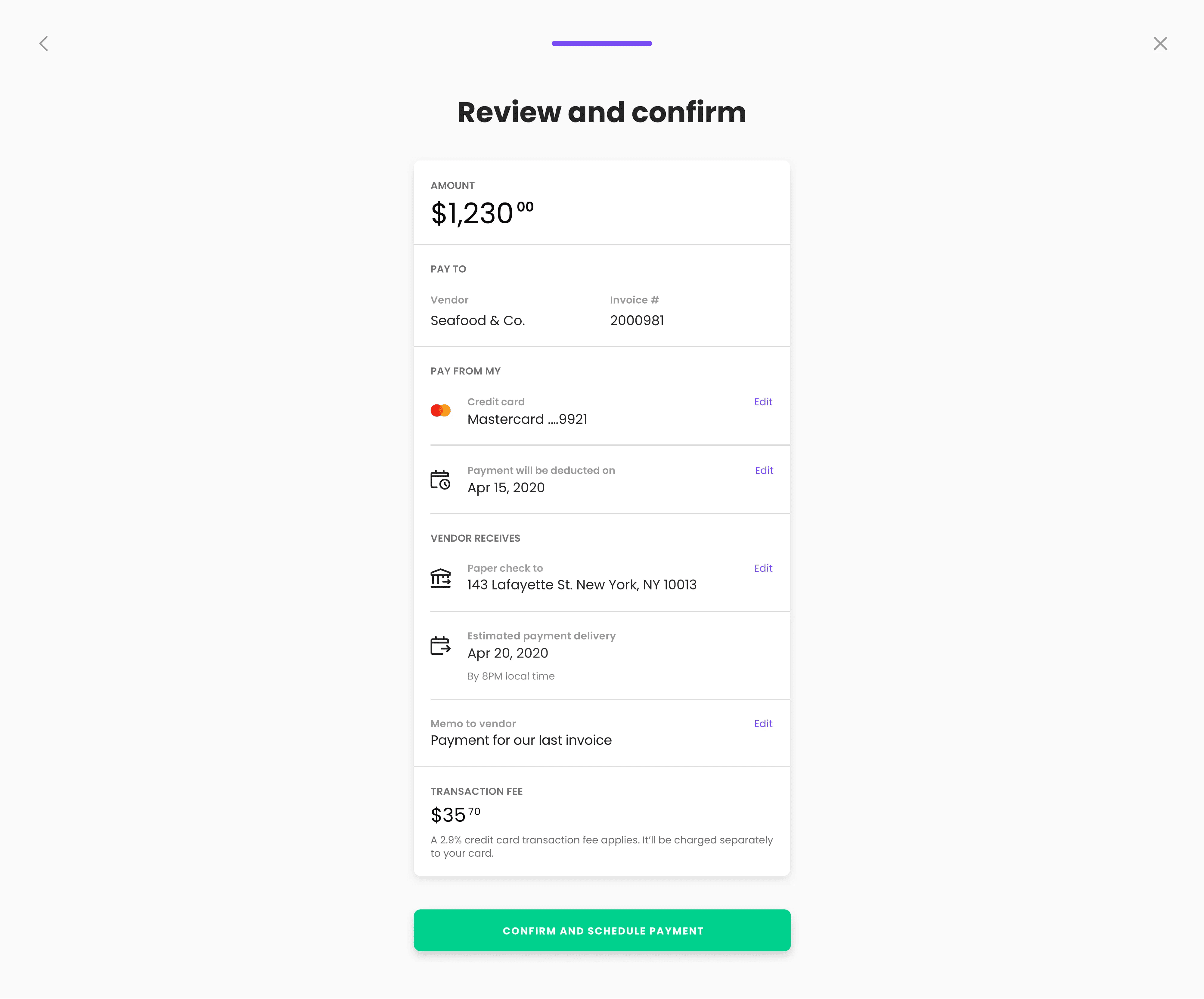

Simplicity is at the heart of Melio. From the moment we signed up, the journey has been straightforward. After registering and verifying our email, we are guided through a clear process: completing business details, adding a bill, specifying a funding source, scheduling a payment, and finalizing it. No frills, no confusion. Just a clear, streamlined pathway to completing a business-critical task.

Moreover, the platform stands out in its dedication to ease of use. While it offers a breadth of features and functionalities that cater to diverse business needs, it maintains an uncluttered and clean interface, ensuring that we users don't get overwhelmed.

This design resonates with small and medium-sized businesses, which often need more dedicated finance teams and rely on simple straightforward tools.

Strategic Cash Flow Management

Melio steps in as a reliable tool during stressful times—such as the holiday season, enabling us to strategically improve our cash flow.

By leveraging the platform's features, we can push payments up to 45 days, a critical advantage during crunch periods. Our ability to pay vendors or contractors, even those who do not accept credit cards, increases our liquidity, ensuring that we remain resilient during tough economic times.

In conclusion, Melio offers more than just a payment platform. It provides businesses with a strategic toolkit to manage their finances, build stronger vendor relationships, and navigate the complexities of today's business landscape.

Global Reach, Local Nuance: Melio's International Payment Solutions

In our exploration of Melio's international payment solutions, we've found a service that remarkably simplifies the complexities of cross-border transactions. Integrating international payments into Melio's user-friendly dashboard, we were able to manage global payments as seamlessly as domestic ones. This streamlined approach is particularly advantageous for businesses like ours, looking to expand their operations internationally.

However, during our use, we noted certain aspects that require consideration. While Melio's flat fee of $20 for international transactions offers transparency, it can become a significant expense for businesses regularly engaging in global trade. Additionally, the limitation to USD for international payments posed a challenge, especially in multi-currency transactions, leading to potential conversion fees.

Overall, our experience with Melio's international payments highlights its effectiveness in simplifying global transactions, while also underscoring the need for enhancements to cater to the intricate demands of international business dealings.

Melio Safeguares Your Transactions with Robust Security

Melio places a strong emphasis on security to protect financial and personal data. Their platform uses advanced cryptographic algorithms during data transmission and in their databases, ensuring secure communication and data storage.

- They have achieved SOC 2 Type 2 and ISO 27001, 27017, and 27018 certifications, demonstrating compliance with high security standards.

- Melio's servers are hosted in data centers that are SOC 1, 2, and 3 certified, with continuous monitoring.

- For credit card transactions, they use a PCI Level 1 certified payment processor, ensuring the highest level of security for card data. Melio also conducts regular security training for employees and follows a strict development process that includes security validations and penetration testing.

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.