TreasuryView : Get all your Loans, FX Exposure and Hedges in One View

TreasuryView: in summary

TreasuryView is a cloud-based treasury management software (TMS) tailored for small to mid-sized businesses (SMBs) looking to manage financial risks tied to interest rates, FX exposure, and debt portfolios. It is especially relevant for finance teams, CFOs, and treasury professionals operating in industries with complex funding structures such as commercial real estate, startups, and the public sector. TreasuryView consolidates financial data across loans, hedging instruments, and currency positions to deliver automated risk insights, scenario simulations, and reporting dashboards. The platform is built to reduce manual work, enhance accuracy, and support strategic decision-making by forecasting exposures and suggesting hedging strategies.

What are the main features of TreasuryView?

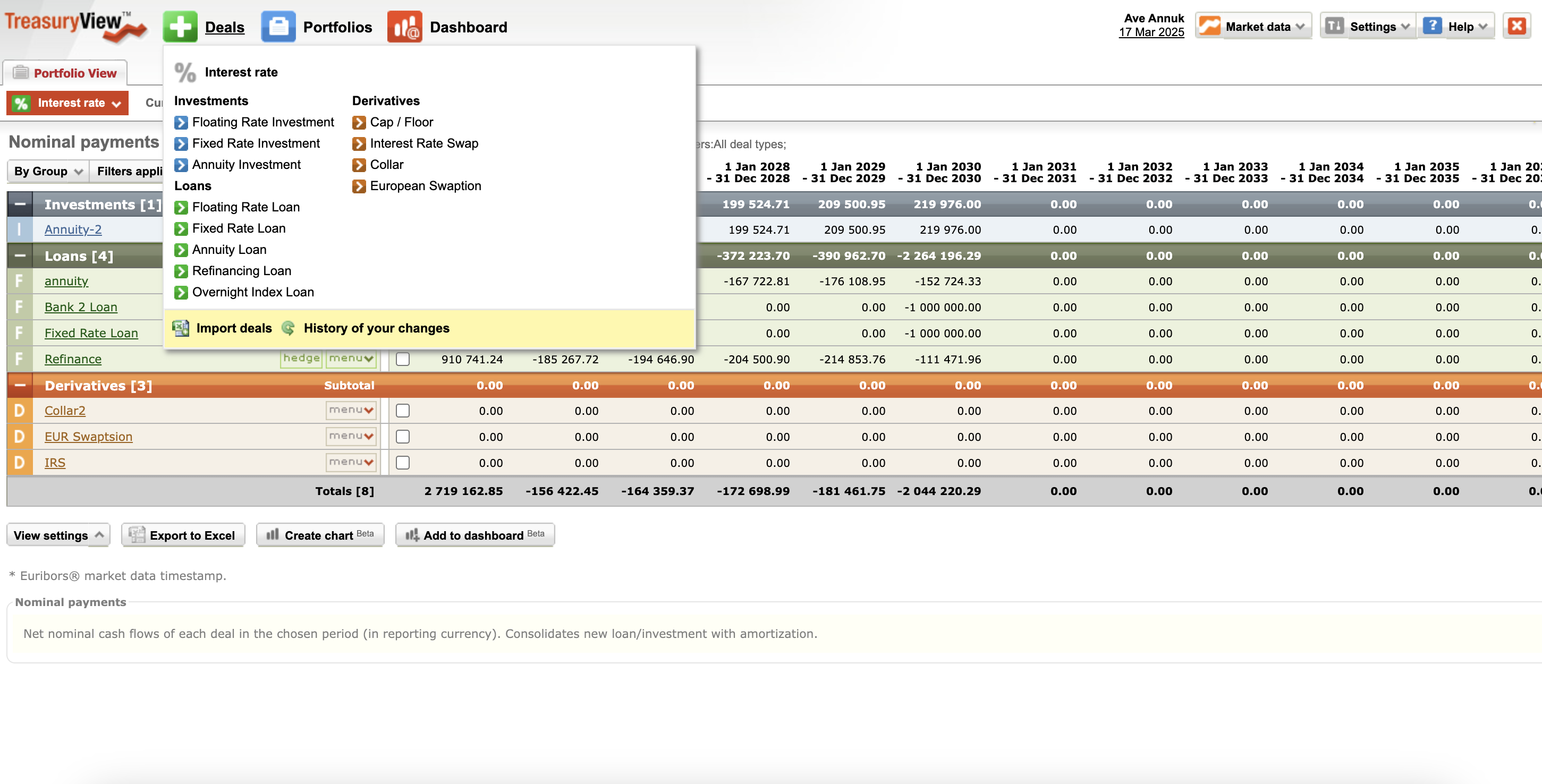

Centralized debt portfolio management

TreasuryView allows users to consolidate all loan data, interest schedules, and repayment structures into a centralized platform. This makes it easier to monitor outstanding debt, interest costs, and repayment timelines.

Users can input data manually or import it directly from spreadsheets.

The system tracks key debt metrics like interest resets and amortization schedules.

Forecast tools help model cash flows related to debt under various rate scenarios.

Real-time updates ensure finance teams have accurate exposure snapshots at all times.

Example: A CFO in a real estate company uses this to monitor multiple bank loans with different interest rate terms and maturities in a single dashboard.

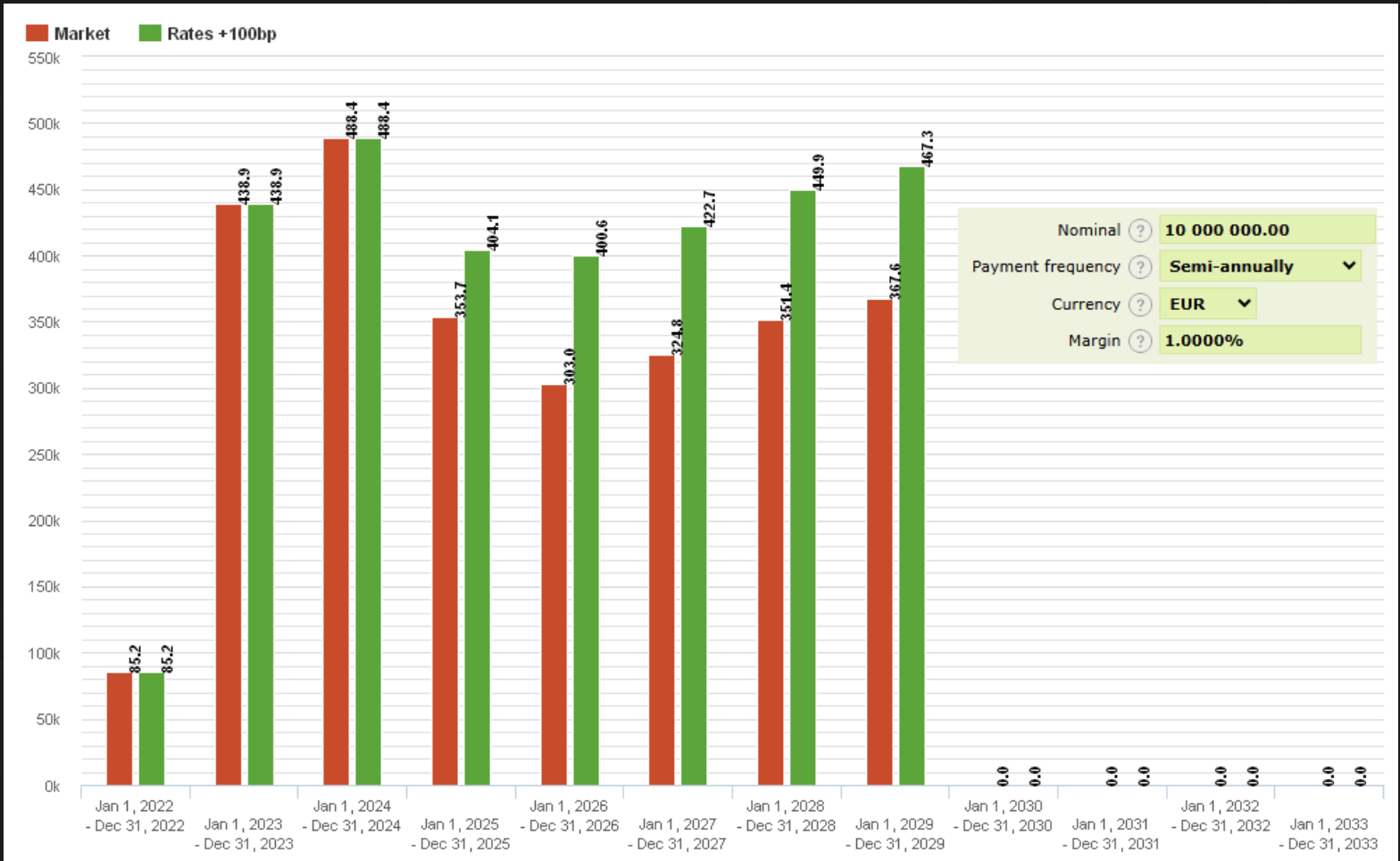

Interest rate risk analytics and forecasting

TreasuryView helps evaluate and simulate interest rate risks tied to variable debt structures and hedging strategies such as swaps or caps. It provides visual tools to assess risk under changing market conditions.

Simulates interest expense changes based on rate curve shifts.

Evaluates effectiveness of interest rate derivatives against debt.

Provides timeline-based forecasts for budgeting and planning.

Example: Treasury managers can compare unhedged vs. hedged interest scenarios before making derivative decisions.

FX exposure tracking and risk simulation

The platform enables finance teams to identify foreign currency risks, monitor their impact on the P&L, and simulate various hedging strategies.

Aggregates foreign-denominated liabilities, receivables, and hedge contracts.

Flags exposure hotspots and market movements that may impact valuation.

Simulates different hedge instruments and compares their performance.

Example: A startup with USD and EUR funding sources uses this to monitor currency mismatches in real-time.

Scenario-based hedging strategy simulation

TreasuryView enables users to explore different hedging options before execution. It visually compares how each strategy would impact financial performance under market fluctuations.

Compares hedged vs. unhedged outcomes.

Supports strategy planning using forward curves and historical volatility.

Custom reports can be generated for internal or external stakeholders.

Example: A CFO can present multiple interest rate swap scenarios to the board, showing potential savings and risks.

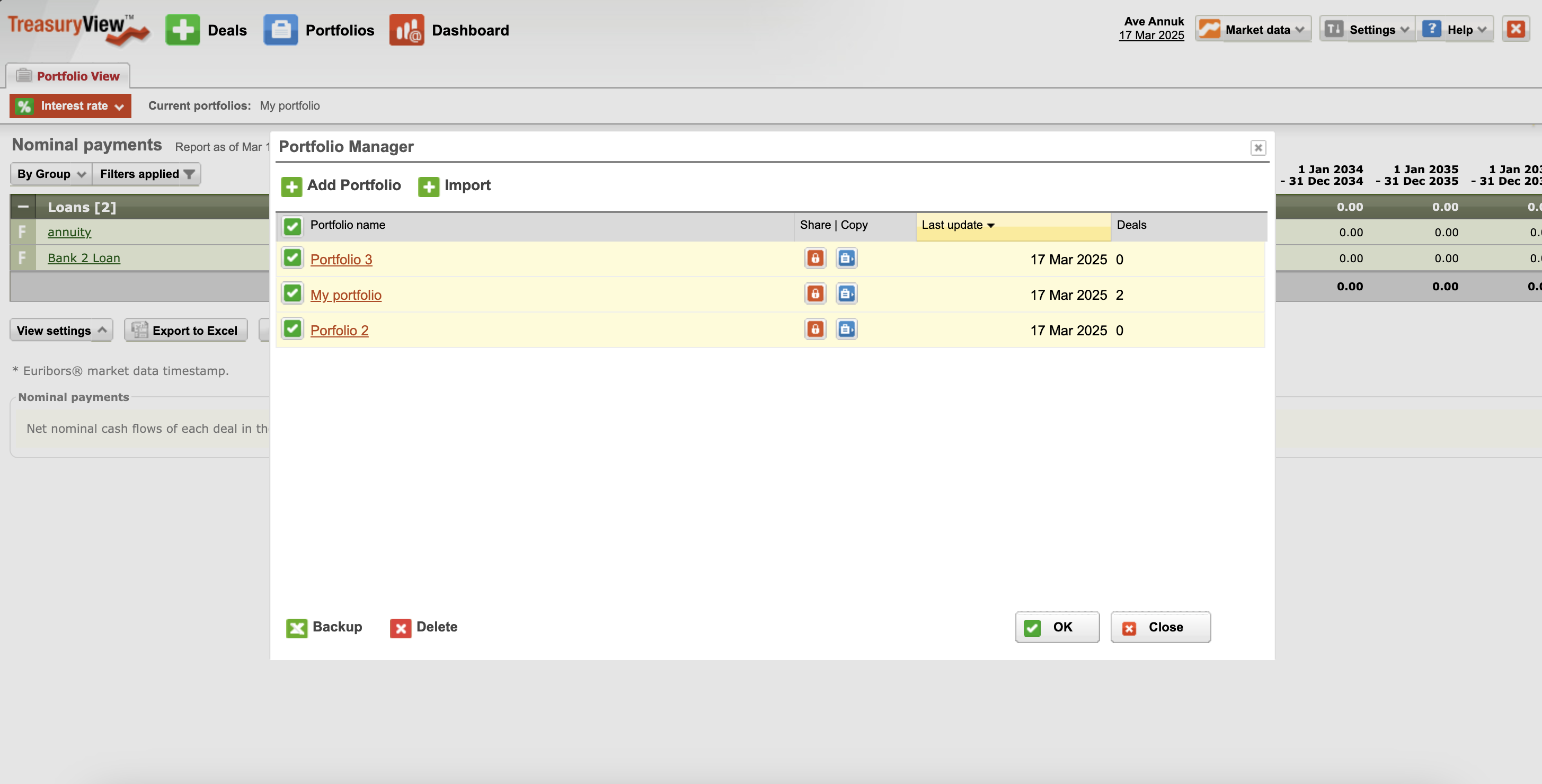

Collaborative reporting and data transparency

By operating as a single source of truth, TreasuryView supports shared visibility for finance and treasury teams, external advisors, and banks.

Cloud-based access ensures synchronized data for all users.

Automated reports can be tailored to audiences like the board or auditors.

Stakeholders can access the same visual dashboards to ensure alignment.

Example: Treasury analysts and CFOs work on the same dataset when preparing board materials or loan covenant reports.

Why choose TreasuryView?

Automated insights save time: TreasuryView automates over 90% of data input, freeing up to 6 hours per week per user for strategic analysis instead of manual updates.

Quick implementation and low barrier to entry: No installation, IT resources, or special training are required. Users can import spreadsheets and begin analysis on Day 1.

Improved financial accuracy and control: Real-time simulations and exposure tracking reduce the chance of unexpected losses tied to market fluctuations.

Designed for SMB treasury operations: Unlike large enterprise TMS platforms, TreasuryView is purpose-built for smaller finance teams with lean resources.

EU-based data compliance: TreasuryView hosts data in ISO27001-certified data centers within the EU, compliant with German and European data protection laws.

Its benefits

free trial, latest market data, easy integration, affordable

ISO 27001

TreasuryView: its rates

Standard

Rate

On demand

standard

Rate

On demand

Clients alternatives to TreasuryView

Manage corporate travel effortlessly with automated booking, expense tracking, and comprehensive reporting features.

See more details See less details

Navan simplifies corporate travel management with features like automated booking tailored to company policies, real-time expense tracking, and robust reporting tools. Its user-friendly interface ensures seamless integration with existing workflows. By reducing administrative work, this tool enhances productivity and cost control.

Read our analysis about NavanBenefits of Navan

No booking fees or hidden costs

Access to exclusive travel discounts

Easy creation of travel policies across the organization

To Navan product page

Powerful desktop publishing software with advanced design tools and templates for creating stunning print and digital media.

See more details See less details

With Yooz, users can easily design flyers, brochures, newsletters, and more with intuitive drag-and-drop tools. The software also features a wide range of templates and fonts to choose from, as well as the ability to import graphics and images for a truly custom look. Plus, Yooz supports both print and digital media, making it a versatile choice for any project.

Read our analysis about YoozTo Yooz product page

Efficient payment processing, easy scheduling, and secure transactions for businesses.

See more details See less details

Melio offers a streamlined payment processing solution, designed for businesses aiming for efficiency and security in their financial transactions. It supports easy scheduling of payments and ensures transactions are completed securely, enabling smoother cash flow management and saving time on administrative tasks.

Read our analysis about MelioBenefits of Melio

Pay vendors the way you want

Improve cash flow management

Vendors get paid the way they want, even if they are not Melio users

To Melio product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.