Finom : All-in-one digital financial service

Finom: in summary

Finom is a fintech start-up that provides digital financial service for entrepreneurs and small-to-medium businesses (SMEs).

We came to bring the technologies of the future to business management processes for entrepreneurs, so that they can focus on what adds the most value to their business and themselves.

All-in-one digital financial service with Finom

Everything you need for business into a single mobile-first platform:

Banking with a few taps on their phone. Open a business account 100% online. Add and manage multiple bank accounts

Issue cards for themselves and employees. Control their employees' cards via our app.

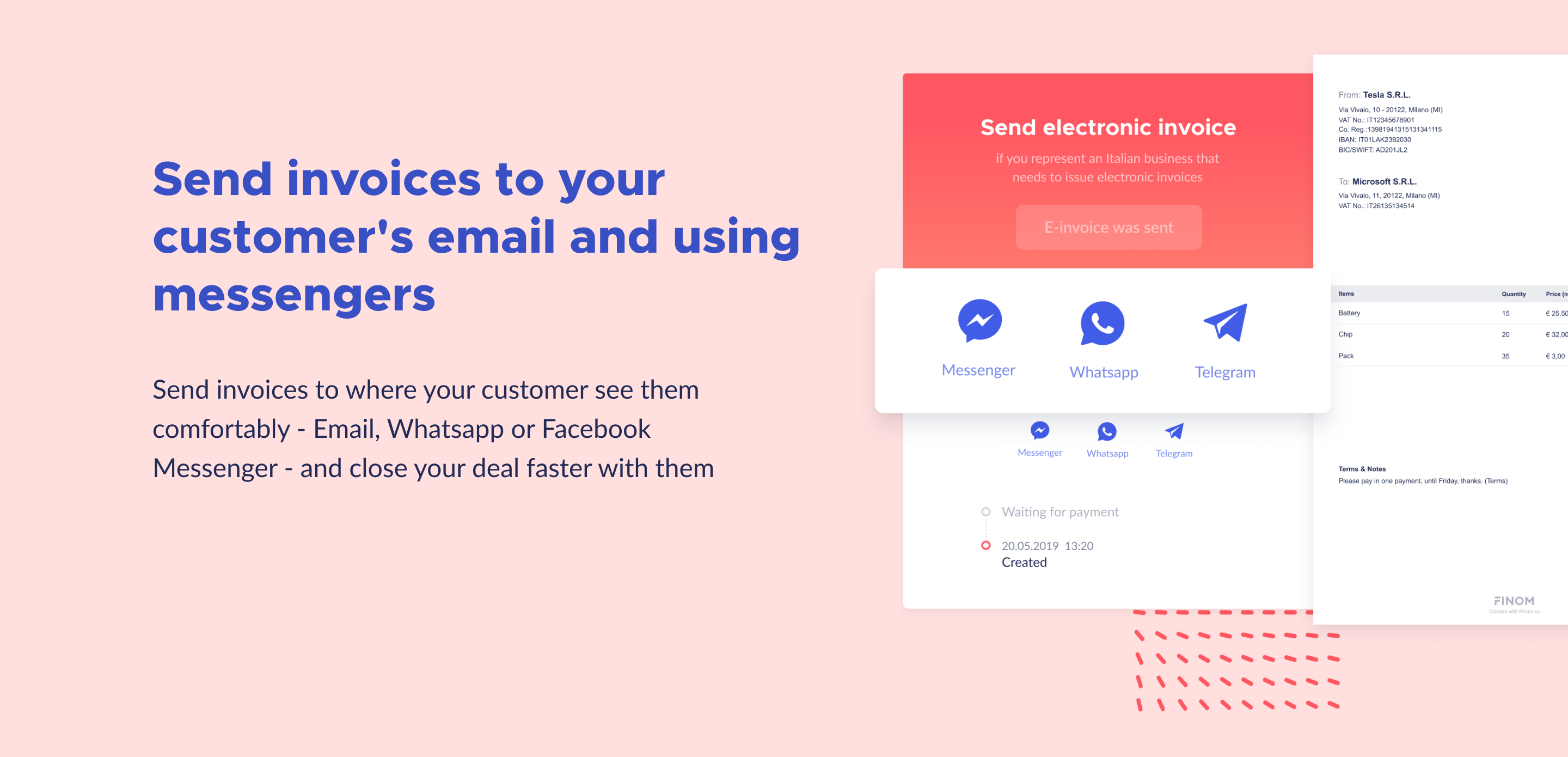

Invoicing. Shared in seconds via email or messenger

Payments. No hidden commissions or fees

Expense management tools. Fully control all cards. Get personal and team expenses in control and keep your books tidy.

Virtual and Plastic cards with Cashback

Free plastic and virtual cards for freelancers and SMEs powered by next-level expense management solution

Up to 3% cashback on every transaction

Up to 10 000€ ATM withdrawal limit per card

Apple Pay & Google Play

Fast opening a business account

It takes 2 hours for freelancers and 2 days for SMEs.

No bank visits

The process is entirely online

There is an option to get German or French IBAN as well

Unite your accounts with Multi-banking

Manage multiple accounts in one place. Link all your bank accounts to Finom within a minute and get access to unified financial data. Find balances, transactions and contractors data in a single interface on mobile and desktop.

Link any bank account to Finom within one minute

Access all account balances, transactions and contractor data from the same screen

Save time with automation and smart features

See all your transactions in Finom dashboard

Expense management

Complete team and personal expense management solution — from issuing cards to exporting accounting-ready data

Categorize and filter your expenses and revenue from different banks in one place. set a limit and labels for all transactions

Issue, top-up or limit cards for employees in clicks

Get employees receipts uploaded with just a camera tap

Bulk export of documents and transactions data

Why you should choose Finom

Our platform combines accounting, financial management, and banking functions into a single dashboard. You no longer have to juggle between apps and tabs to get your finances organized. You can do that via just one app.

We improve Finom every day based on entrepreneurs' needs and wants. Our support answers within a minute - and we take the feedback from them and make improvements right away.

In this digital era - it’s time to keep your bank in your pocket at all times.

Finom advantages

Cashback up to 3%

Multi-banking

Withdraw up to €10,000/month

Expense management

Bookkeeping automation features with accounting software integrations

Unlimited invoicing

Reach the support team in less than 5 minutes

Your money is protected by online security standards

Fast and reliable integrations with other financial services

Its benefits

Fast opening a business account

Up to 3% cashback on every transaction

Up to 10 000€ ATM withdrawal limit per card

GDPR

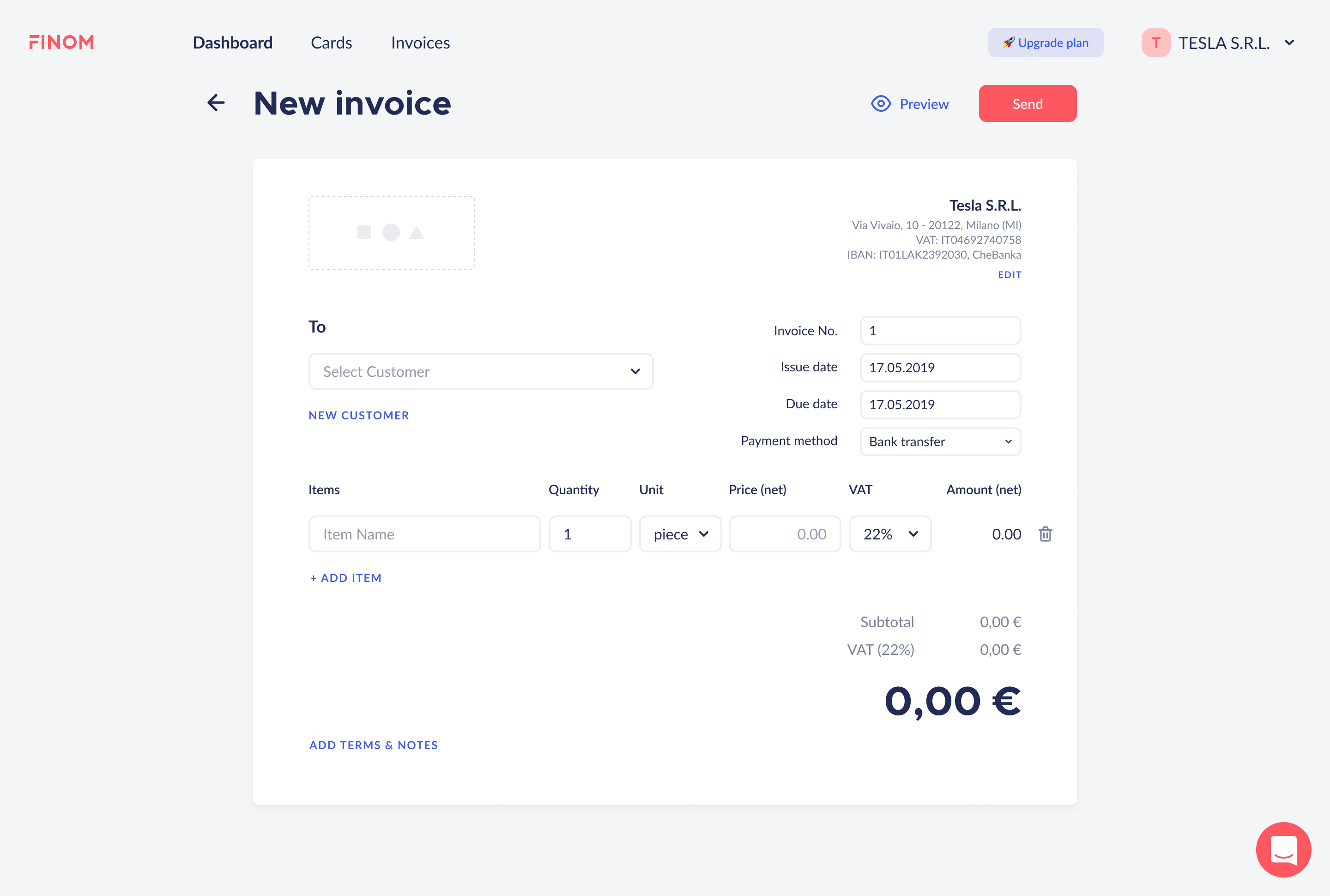

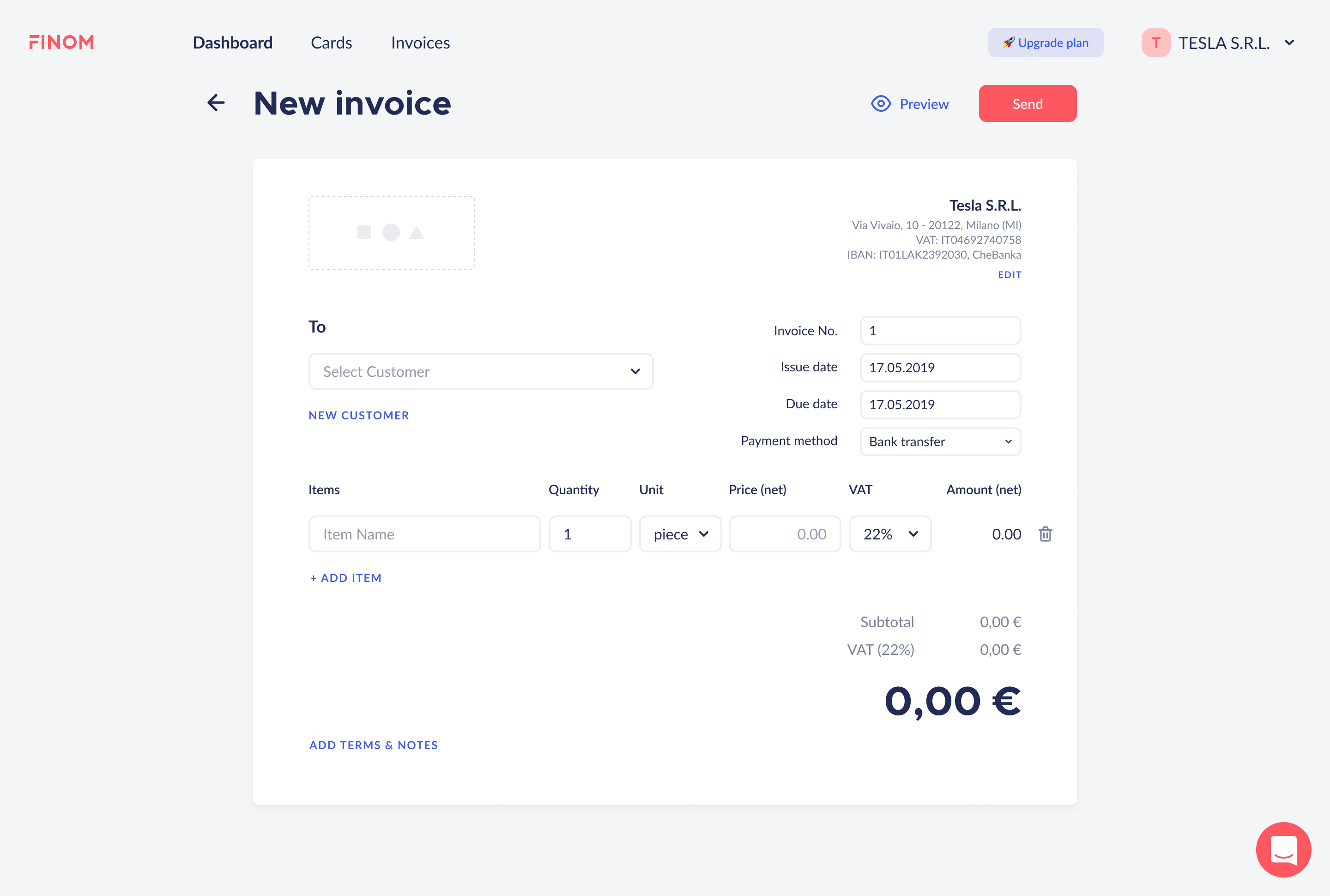

Finom - Screenshot 1

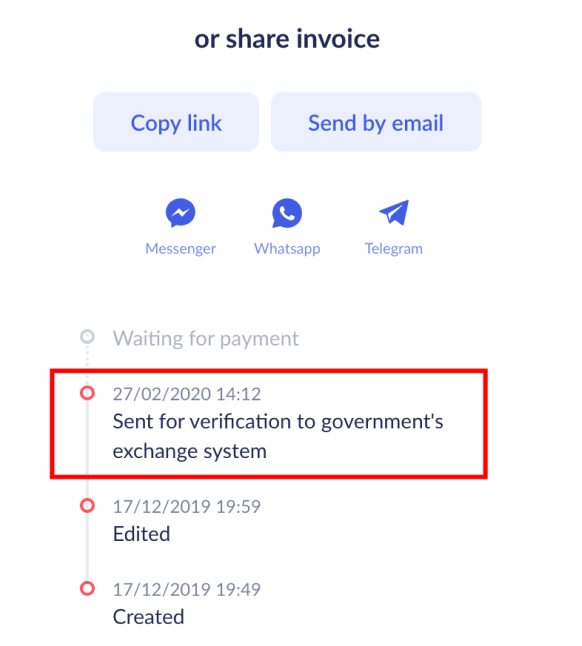

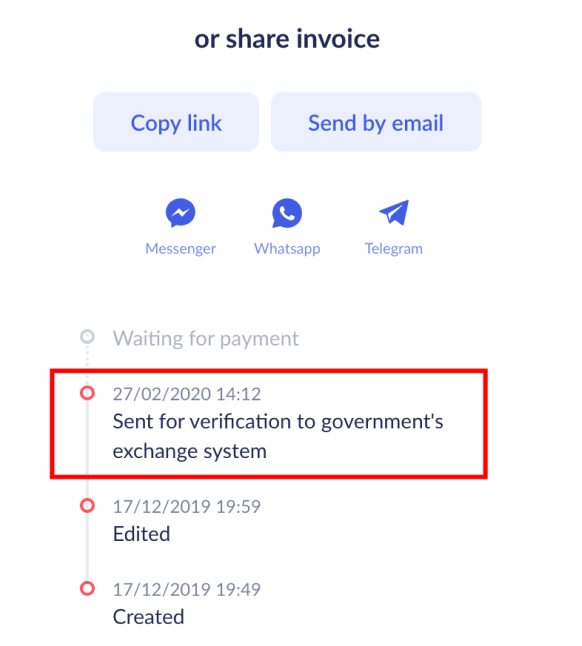

Finom - Screenshot 1  Finom - Screenshot 2

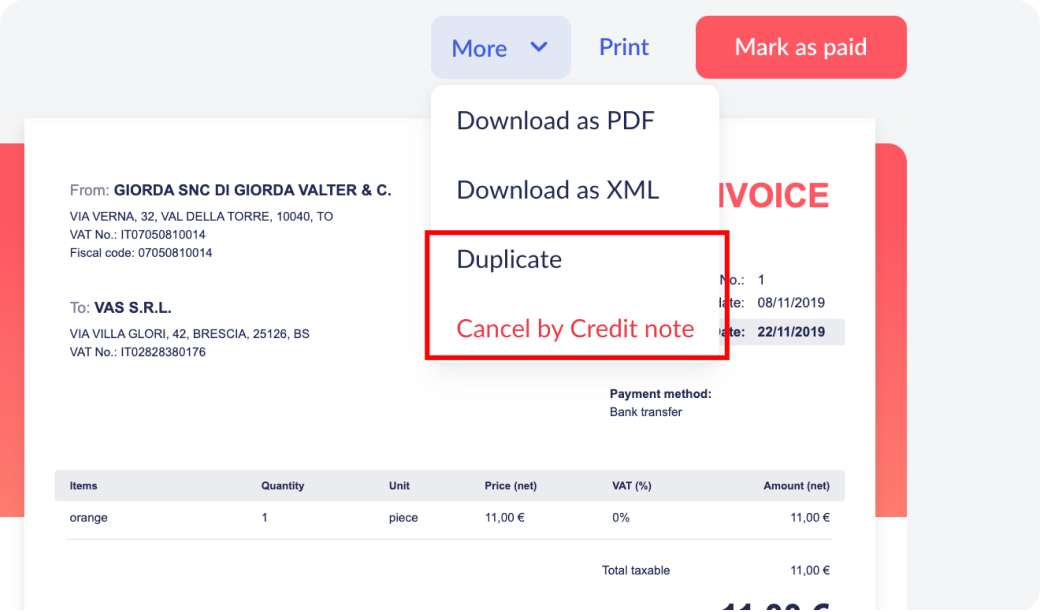

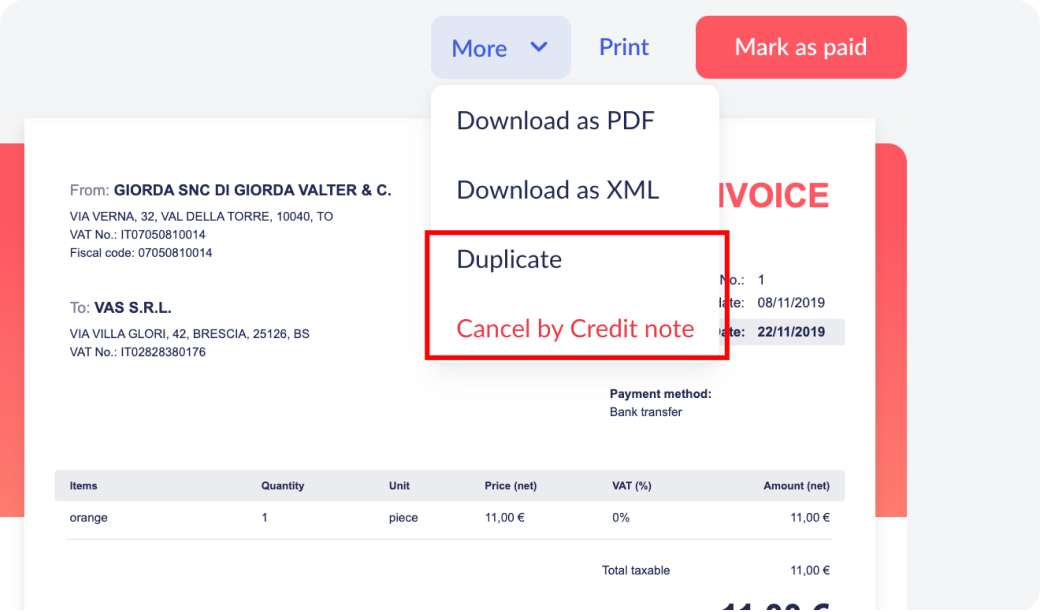

Finom - Screenshot 2  Finom - Screenshot 3

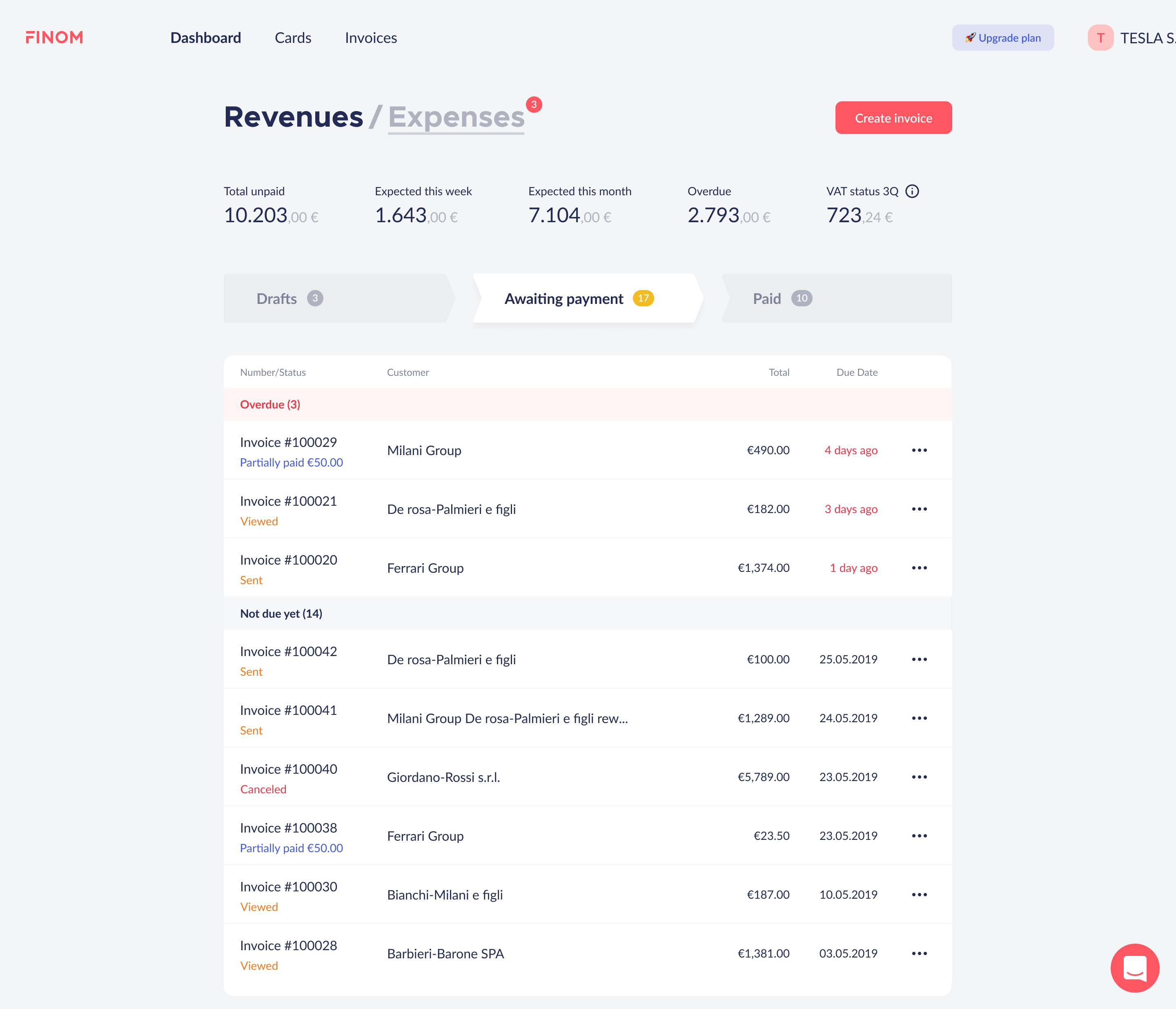

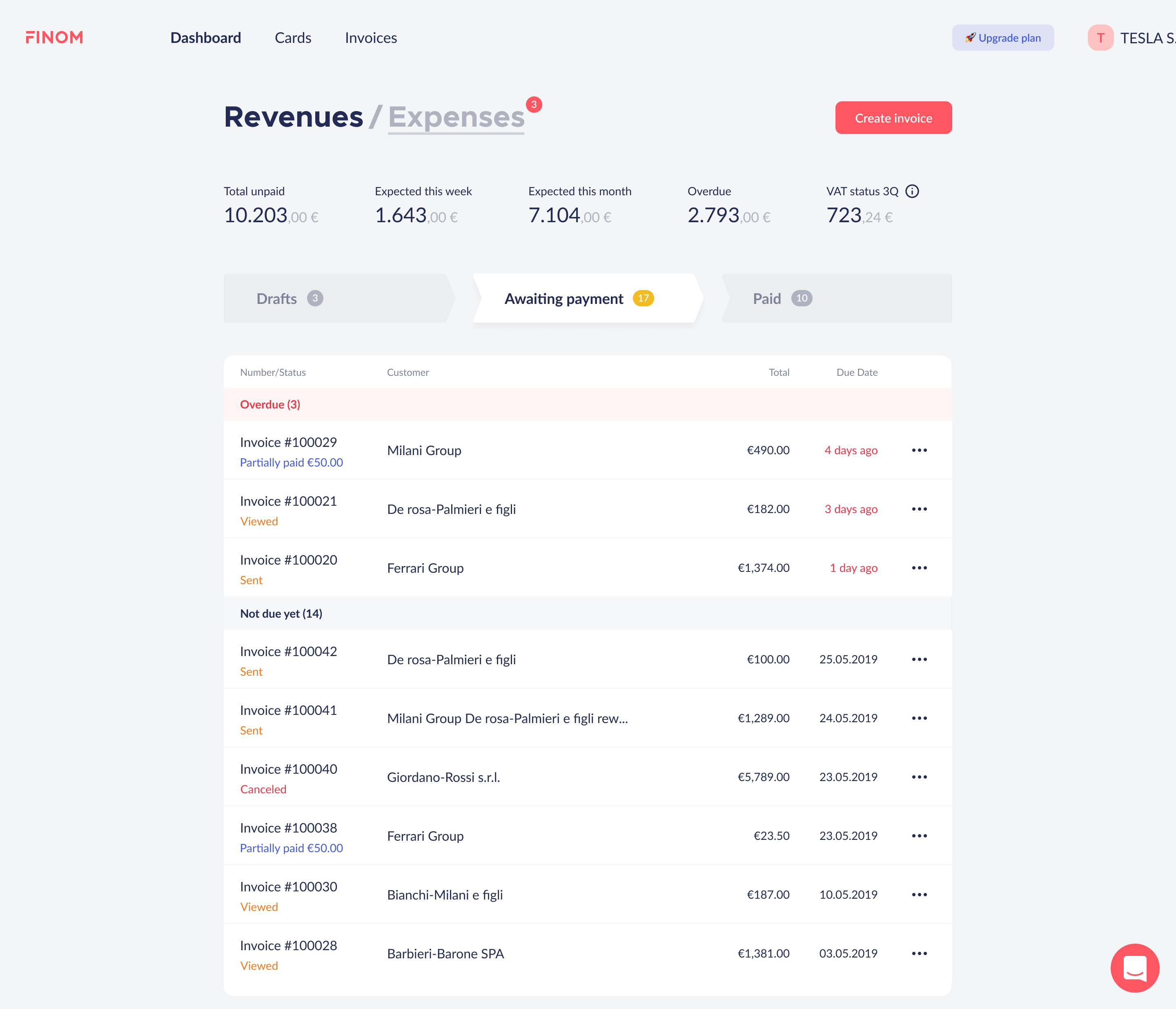

Finom - Screenshot 3  Finom - Screenshot 4

Finom - Screenshot 4

Finom: its rates

Solo

Free

Standard

€4.99

/month /user

Premium

€9.99

/month /user

Clients alternatives to Finom

Efficient payment processing, easy scheduling, and secure transactions for businesses.

See more details See less details

Melio offers a streamlined payment processing solution, designed for businesses aiming for efficiency and security in their financial transactions. It supports easy scheduling of payments and ensures transactions are completed securely, enabling smoother cash flow management and saving time on administrative tasks.

Read our analysis about MelioBenefits of Melio

Pay vendors the way you want

Improve cash flow management

Vendors get paid the way they want, even if they are not Melio users

To Melio product page

Empower financial management with secure transactions, budget tracking, and real-time reporting tools for seamless banking experiences.

See more details See less details

Indy Compte Pro offers a robust suite of features designed to enhance financial management. Users can perform secure transactions, track budgets effectively, and generate real-time reports that provide insightful data analysis. This comprehensive solution streamlines banking processes, ensuring users can manage their finances effortlessly while maintaining high security standards. The intuitive interface and automation capabilities further enhance the user experience, making it an ideal choice for individuals seeking efficient financial tools.

Read our analysis about Indy Compte ProTo Indy Compte Pro product page

Streamline financial services with this software. Manage transactions, automate workflows, and increase efficiency.

See more details See less details

This banking and financial software offers a range of features to improve your financial services. With the ability to manage transactions, automate workflows, and increase efficiency, this software streamlines your financial processes. Whether you're a bank or financial institution, this software is designed to help you meet your needs.

Read our analysis about ParticeepTo Particeep product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.